I.

Introduction ^

«And covenants, without the sword, are but words and of no strength to secure a man at all»

Thomas Hobbes

We are living at a turning point. Day by day, new game-changing technologies are being developed under our eyes at an incredible pace. But how does it differ from the usual development of mankind’s history? The answer is that never before did we rely on such efficient tools to create knowledge and support our intelligence. While yesterday the machines served mostly to complete physical tasks, today, we can count on machines and computing to augment our intelligence and even automate our thinking.

With regards to the legal sphere, one of the most significant novelty is the emergence of smart contracts, which is the topic of this contribution. For now, we may roughly describe a smart contract as a computer code enforcing rules and consequences. The program notably enables the automation of legal prose under a logic of «if /then»1. It is nowadays a theme in vogue in the legal community, even though we note that this process of automatization can be traced back in the works of an eminent Swiss jurist already 40 years ago2.

In order to give the reader guidance on this technical subject, we first must distinguish smart contracts from two others related topics, that are Blockchain and crypto-property. The three of them are often blithely mixed, which may create confusion. Consequently, the reader can picture: first the Blockchain, as the register where smart contracts are stored and crypto-property is recorded. Secondly, the crypto-property as the value that is transferred. And lastly, we have the smart contract, which sets all the conditions and consequences for the transfer of crypto-property.

The first part of this article will treat the basic technical aspects of smart contracts (Infra n°II). Then, in a second part, we will give a legal analysis over smart contracts, mostly considering Swiss law (Infra n°III).

II.

Technical Aspects ^

1.

Did You Say Contract? ^

The term «smart contract», was invented in the 1990s by Nick Szabo, a US lawyer and computer scientist. Even though the name comes from his successful attempt to model an actual legal contract in computer code, this term is rather unfortunate for two reasons. First, he wished to identify an analogy in terms of structure between law and informatics, not to assimilate them. And secondly, because smart contracts aim specifically to emancipate users from traditional intermediaries, or «Trusted third parties», which includes legal players.

In analysing the expression, we find the first word «smart». It refers to the degree of complexity and adaptability of smart contracts. However, a smart contract doesn’t «think», like a lawyer does or – who knows? – an artificial intelligence might one day be able to do. Instead, smart contracts enforce the lines of computer code, which they have been programmed for.

The second word «contract» is once again misleading5, because the term is not to be understood in its legal sense, that is to say a source of legal obligations. It rather, means smart contracts can act autonomously. This is the reason why some developers prefer the term «agent» instead of «contract»6.

Finally, we may now propose a broad definition for smart contracts. It is however challenging to articulate, since the notion is technical and currently gathers no consensus. Further, an accurately delimited definition might be subject to future changes regarding the juridical or technical system where we are looking at. Hence, there might be a multitude of smart contracts, but they can be brought under this general definition: «A smart contract is a software, which computer code binds two, or a multitude, of parties in view of the execution of predefined effects, and that is stored on a distributed ledger»7.

2.

Examples ^

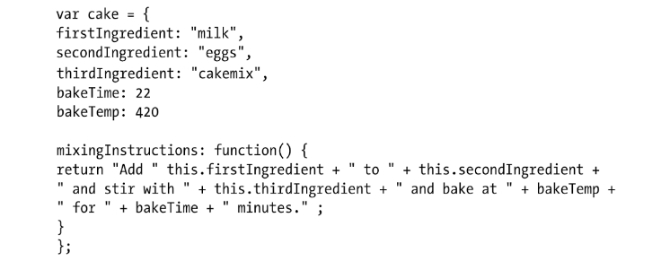

Another, more complex example, is the option contract. In this case, the smart contract imitates the effect of a financial contract. The holder of the right is allowed to buy one round lot of 100 shares of XYZ Corporation for 20$ per share, on or before the last trading day of August. This time, the example underlines the types of rules that can be enacted, and gives an idea of how it could be useful to automate it.

Source: Szabo8.

3.

Functioning of Smart Contracts ^

From a technical point of view, a smart contract simply is a piece of computer code. Nevertheless, the processing generally requires four elements in order to work properly9:

- The source code

The computer code contains all the details of the wanted transaction, where a transaction describes the transfer of an information (e.g. a smart contract). - The wallet

The wallet is the digital space where cryptographic keys are hold.

Briefly, there are two types of keys. First, a private key that allows users to access a crypto-property and enables to control their account (Externally Owned Account or EOA)10. And second, a public key, the function of which is to authenticate messages’ holder and encrypt messages. Note, the address of the EOA is derived from the last 20 bytes of the public key. Finally, both the private and the public key are paired to enable secure communication. - A storage file

The storage file is a digital space where a transaction is stored before it is registered, which most often takes place on a Blockchain. - The register

This register is where the transaction is stored. Most of the time it takes place on a Blockchain.

Source: Juels/Kosba/Shi11.

4.1.

Blockchain ^

Blockchain or Distributed Ledgers is not the topic of this contribution. That is why we won’t develop this theme and its functioning deeply here12. Nevertheless, we need to address some aspects of it since Blockchain technology is intrinsically intertwined with smart contracts because, as mentioned above, it forms the usual storage place of smart contracts13.

There are two main characteristics of Blockchain that we must mention. First, the data registered on a Blockchain is distributed among a network, and is cryptographically secured. Consequently, the system is very difficult to hack without utilising considerable resources. And second, once registered, data on a Blockchain can be depicted as immutable and perpetual14. However, we must tamper those assertions. It is undebated that several sorts of Blockchain exist and none is 100% infallible. They all have their specificities and proper weaknesses. Let’s take some examples.

For instance, let’s look at the consensus mechanism within a Blockchain, whose raison d’être is to keep a uniform record of all transactions. The consensus can be realized through different methods. One of them is named the proof of work, which enables the 51% of users to alter the Blockchain democratically and unilaterally. Consequently, this method shows weaknesses in cases where a participant, or a group, monopolize a significant computational power. In such a hypothesis, the majoritarian participants on the Blockchain can collectively decide to «fork» and, as it happens during the post-DAO event, decide for instance that a transaction never occurred.

Regarding immutability of a Blockchain, we would like to stress that this characteristic does not mean a Blockchain is invulnerable. Indeed, in theory it is possible to destroy it (although it is hard) or more plausibly, a Blockchain may be overcome by a superior chain. Furthermore, a Blockchain can be discarded by the effect of time if nobody uses it anymore. Simply stated, would you bet that each and every one of today’s existing Blockchain will be there in 100 years?15

4.2.

Blockchain’s Effects on Smart Contracts ^

First of all, as the Blockchain is immutable, the registration on it enables to create a self-execution effect of the smart contract’s clauses. The computer code constituting the smart contract will be executed without anyone having the capacity to change it. This effect is very beneficial, notably in situations where parties are very remote, since the legal effects of the contracts are hence automated irrevocably and do not require any legal intervention. Further, this presents significant advantages regarding international transactions.

However, a smart contract is not immutable in all conceivable scenarios. As we stated above, firstly, the Blockchain might be forked by a majority of users. And second, the computer code of the smart contracts can contain several functions that enable a certain range of flexibility. For instance, we can mention functions as «callcode», «enums», «selfdestruct», and also variable functions enabling the smart contract to process external inputs16. Thirdly, the registration of smart contracts on a Blockchain has a cost called «gas» on Ethereum. Consequently, smart contracts’ computer code cannot be too long and explicit. This characteristic disables the use of thorough complicated rules in smart contracts, as U.S. legal contract drafters are acquainted with.

III.

Legal Analysis ^

«Le Droit? On ne sait pas ce que c’est!»

Gustave Flaubert

1.1.

Legal Theory ^

Firstly, we begin by addressing the normativity of computer code. As a matter of fact, a smart contract’s computer code can well be considered as a kind of regulation sui generis, as it resembles the law in its effects. Indeed, both create normativity within their systems and allow «an alternation of the behaviour by means of standards»17, hence forming a regulation lato sensu. Further, the design of computer code or legal rules always reflects, consciously or not, the «politics» of its creator, making developers and legislators the Deus ex machina of their own normativity within their respective ecosystems.

If legal regulation and computer code are similar in many ways, they have very important differences nevertheless. Among them is that the computer code is created by private actors and in a decentralized manner. On the opposite, the sources of legal regulation can be said to be centralized among recognizable and legitimate actors (e.g. states, judges). They share different goals and also differ regarding their respective standards of quality and integrity. While states are obligated to ensure the maximization of social welfare, this is not, at least not by default, the role of private actors.

Secondly, law and computer code form parallel systems evolving from one another autonomously in terms of normativity and logic. One regulates the sphere of society and the other regulates an informatics system. Where, according to Luhmann’s definition: «A ‹system› can be understood as a distinct discourse where a specific ‹language game› (i.e. law, politics, economics etc.) is practised according to autonomously generated ‹grammatical› rules»18.

For instance, a computer code won’t take into account the possible nullity of a legal contract unless taught to. Instead, its system is based on its own norms and will execute the agreement according to its given design only. As a consequence, the phenomenon of smart contracts registered on Blockchain is problematic19. Notably, because discrepancies can occur between the two systems (legal / informatics), which may result in unfair and unlawful smart contracts being enforced. This result is detrimental to the welfare in our society to the degree that computer code is used to regulate social behaviour outside of legal solutions.

Eventually, the ultimate answer is then to say that computer code, and by extension smart contracts, is legally relevant to the degree that it creates a normative means to regulate social behaviour, which competes with the scope of application of legal regulation. The challenge is then to create permeability between the two systems and set bridges between them in order to reduce imperfection and create a legally compliant computer code, which combines the efficiency of computer code with all the guarantees from the legal norms.

1.2.

Does the Law Apply ? ^

A few pioneers of Blockchain and smart contracts, mostly coming from the Cypherpunk movement, do consider that the Blockchain does not need any regulation, as it is technically already regulated via its protocol. However, those protocols do not overcome the power of legal regulation. Indeed, the law, lato sensu, is the immemorial means to regulate human society20. Most often, it is not limited to any particular form as long as the materiality of the situations the regulators wanted to be regulated can be met.

As underlined in art. 1 al. 1 Swiss Civil Code (SCC)21, the law applies whenever its spirit is met: «La loi régit toutes les matières auxquelles se rapportent la lettre ou l’esprit de l’une de ses dispositions»22. Further, the law forms an evolving concept, which fluctuates over times: «Le texte est appelle à n’avoir que le sens contextuel fluctuant que lui donnent ceux qui l’utilisent»23. Hence, the criteria is the recognition of the legislator’s designated behaviour inside the multiplicity of the possible occurrences of the law that may appear over time24. Consequently, we advocate that smart contracts shall be seen as a new expression of the law, which evolves in a system autonomous from it.

Eventually, as people we live in a system based on society. This model draws its regulation mostly from legal normativity. Thus, the origin of the legal regulation is not the system that composes the Blockchain or smart contract. But rather, the law is imitated by the computer code, because it is there that the original source of legal obligation occurs and effects the society25. A very famous quote is Lessig’s «Code is law»26. Briefly, we simply believe, that we should understand that «law is law » and «code is code», but from the perspective of the legal system, when the normativity of the computer code imitates the law, then «Code is actually just law».

Let’s give a quick example. Imagine you pass a sales contract orally and register it on a Blockchain. In the eventuality the Blockchain gets destroyed, would you still have concluded a valid contract with regards to the law? Even though the effects of this contract aren’t self-executable anymore because the Blockchain is destroyed, there still is the hierarchically superior means to claim your rights, that is the legal system. Hence, without a form of legal existence or recognition, a smart contract is simply a non-binding piece of computer code that claims the proof of something, in our example a sales contract, and bearing in itself no more legal effects but the one its compliance with the law grants.

This is for the best, because if a Blockchain or smart contract ever fails or appears to be unlawful, then the legal system remains the one truly immutable and legitimate back-up system that can rectify this. This analysis goes also in the direction that was recently taken by the U.S. State legislations of Arizona and Vermont27. In summary, both States decided to recognize legal effects for the information that lies on a Blockchain or a smart contract, hence incorporating it explicitly as part of the legal system. Furthermore, this approach is also consistent with the recent reaction of several market authorities, stating that security law may apply to the sales of token during an Initial Coin Offering (ICO)28, incorporating them de facto.

At this stage, it is important to note that smart contracts have everything to gain from the application of the law. First, they will contribute to enhance the use of the smart contract, and their worthiness by making them not solely technically but also legally enforceable. Moreover, it would contribute to reduce the market volatility of tokens. Nevertheless, if the law applies to smart contracts in general it certainly does not particularly apply to all of them. Accordingly, we assess a case-by-case analysis explaining how the law applies to them beneath.

2.1.

Overview ^

People are more and more conscious that data, of any kind, has a concrete value. This notion of value encompasses some notions of economy (how much is something worth in terms of money?30) but also a societal judgement (how much is it worth to me or to the group?)31. This discussion is intimately linked with smart contracts because, conceptually, we can reduce them or other digital property to a sequence of numbers and signs, i.e. data32. But how do we legally protect them?

In response to this growth of consideration for data, some authors have advocated the creation of a specific property right over data33, whilst others wish to include data under the notion of things34. The latter take a functional approach of the legal notion of things, which might then be subject to rei vindicatio (art. 641 SCC or possessory actions [art. 919 SCC])35. But this assimilation of data as subject to property law is challenging. Indeed, data can be easily reproduced, their titulary is hardly determinable and may depend on the legal regime applied or the different contractual relationships involved36.

As of today’s state of the law, Swiss regulation only protects some specific types of data. For instance, personal data or IP, but most of it (e.g. market data) does not fall under the legal scope of protection. In this view, most smart contracts data is excluded from the scope of protection of the law. Consequently, we observe that the current approach of the regulation is to create rights of protection over specific data via some ad hoc regulations, rather than creating a general statute for data that would be similar as the one created for things under property law. The difficulty derives from the fact that most of the doctrine agrees in saying that data cannot be considered as things in the legal sense37 but still has a value that should be legally protected.

Some solutions are being developed in practice. In particular, regarding Blockchain’s data, the Swiss law firm MME released a framework for the risk assessment of ICO, which proposes the concept of a «Blockchain Crypto Property» or BCP. They define BCP as: «(1) Digital information containing all elements of a property right, (2) that is registered on a Blockchain or in an alternative distributed ledger, (3) which can be transferred via a protocol, (4) and that may (or may not) carry out additional functions governed by an SCS, following coded and/or manual input»38.

Overseas, in the U.S., two bills particularly relating to smart contracts are worth mentioning. The first relates to the state of Arizona. Section 44-7061 D of the Arizona revised Statute describes that Blockchain is a way to «secure information», hence presenting it simply as a record of proof. The section provides that the owner of secured information retains a right of use or ownership over this information39. We note that the statute does not consider data as «things», nor «right» or even explicitly «value», but only as «information», or any data actually. Further, we can note that the data or information is owned by the user, however nobody verifies if this ownership has a legal reality in the first place. And last but not least, this right and the proof of record reserve the application of other existing laws. Consequently, we believe this section might pose some practical difficulties and that its primary goal was to make the State look pro-Blockchain in order to attract Blockchain-based companies.

Secondly, the State of Vermont has also released a Bill relating to Blockchain and smart contracts. The bill H.868 added the section I.1. 12 V.S.A. § 1913. It creates numerous legal presumptions. First, that Blockchain records facts that are presumed «authentic» (§ 1913, b) n°3 and n°5). Nevertheless, this presumption does not extend to the truthfulness, validity, or legal status of the contents of the fact or record. Further, the burden of proof that a record is «not authentic» is at the burden of the person against whom the fact of the Blockchain recorded information operates. Those presumptions apply notably to the record of ownership and contract (§ 1913, c)).

2.2.

An Opinion ^

We believe that data, and hence by extension smart contracts, cannot be assimilated as such under the legal concept of things. First, a record of data, and be it on a Blockchain, does not represent a property right of ownership since it is not valid erga omnes40, nor is it easily recognizable by third parties and thus does not fall under the numerus clausus of the property right. Indeed, even though Blockchain is very secure, there is no insurance that the same «object», for instance a token representing a merchandise, is not also registered on several different independent Blockchains and sold multiple times. Second, in order to be consistent, there is no possession right that can be deduced either, since data cannot be considered as a thing. Notably, no possession is created from the owning of a private key, giving access to a digital / virtual property41. Instead, we believe it should rather be seen as a right to access or transfer data42, which happens to have a value or not.

Eventually, we are not hostile to the creation of a specific general right of property to data. We simply do not see the use of it, as long as data can be more easily regulated via a mechanism of legal protection imitating property rights instead. In the end, rights of property on things only exist thanks to a legal fiction. Hence why not create a legal fiction of ownership for data, too? For the moment, we believe there is no need to create a new legal statute for data if the law succeeds to create, as for personal data, a framework that protects the data in a erga omnes manner. This way, we could functionally give property rights, and adapt a lighter regime of property, as it was made in the Federal Act on Intermediated Securities (FISA)43. With regards to Blockchain and smart contracts, we envisage the following viable solution: i) the law recognizes official Blockchains that are exclusively acknowledge by governments44, ii) the law sets rules about the legal effects and ownerships over Blockchain, smart contract and data45, iii) the Parties mandate third parties (so-called «oracles») to look up for conflicting situations among independent Blockchains, and vi) the Parties use contract law to insure their rights and prevent eventual damages.

3.

Case-by-case Approach ^

In order to properly assess the smart contract’s legal problems, we first need to differentiate between the forms of things, rights or value it may encompass46.

3.1.1.

Data without Legal Impact ^

The first category represents data that can be qualified as having no legal impact. The vast majority of data falls under this notion. For instance, we can mention computer code that forms the infrastructure of a website or market data. Regarding smart contracts in particular, we can mention the function greeter47, the whole purpose of which is to say «hello». Finally, we leave open the situations where an accumulation of individually insignificant data may jointly have a legal impact (so-called big data).

3.1.2.

Data Protected by Law ^

The second category is data protected as such by law. For instance, we can mention all the data falling under IP law and data protection’s regulation. Further, some data might fall under this category when they are indirectly covered by the regulation. For instance, if someone deletes all my PDF files, the law recognizes a value to this data in art. 144bis of the Swiss Criminal Code48. Also, we would classify a future «property right on data»49, which imitates property right in its effects, under this category.

3.1.3.

Data Representing a Virtual Property or a Digital Property / Commodity ^

The third category basically represents any data that does not fall under the other categories. Hence, it is negatively defining all data with value that is neither a thing (or its representation), nor a right (nor its representation), nor data protected by law.

We wish to stress here that neither digital, nor virtual property are given a juridical value. For instance, even if a Bitcoin is worth $10’000.– today, economically speaking, it does not constitute as such an absolute or a relative right to this amount. The legal ownership of a bitcoin can be resumed as having a right to access to the data that is Bitcoin, whatever its worth.

a)

General ^

In this contribution, we define50 virtual property as any data with value that is neither a thing, nor a right, nor data protected by law, and for which there is no actual market that may concretizes it into fiat value.

The essential idea is that a virtual good may have, or does have, a value but there is no actual exchange place where it could be traded or transferred51. Let’s take an example: imagine you play a game named the Sims52, where the value of the money or items existing in this game cannot be exchanged back to fiat currency. You won’t be able to exchange the asset of your virtual labour because there is actually no market for that, hence no possibility to concretize this value.

b)

Legal Consequences ^

Consequently, we cannot estimate that you «own» more patrimony with the digital value represented. The probable only defence you might generally have against the loss of the virtual property will be an eventual contractual right.

a)

General ^

In 2014, the Swiss parliament defined the notion «virtual currencies»53 like Bitcoin. It stated that virtual currencies were: «une représentation numérique d’une valeur, négociable sur Internet et remplissant les fonctions de la monnaie»54. Hence, we can state that digital property represents any data with value that is neither a thing (or its representation), nor a right (nor its representation), nor data protected by law, and for whom there is an actual market, which may enable to concretize the value55.

For instance, we can consider Bitcoin56, Ether57, a piece of gold or items on World of Warcraft, and most Altcoins to be falling under this category. In those example, we can see that the value of the virtual property is easily transferable into fiat money because of the numerous existing exchange places. Even though the aforementioned examples are not things, nor an immaterial right58, … and simply more generally mostly unforeseen by law.

b)

Legal Consequences ^

First of all, as it can be part of the patrimony of someone, its diminution constitutes a damage in the legal senses, which would constitute a diminution of the patrimony that can be claimed in front of the court under art. 41 and 9760 of the Swiss Code of Obligations (SCO)61. Further, the action of unjust enrichment should also be opened62.

The second important effect is that if constitutes an asset subject to tax law63. This would seem fair since the contributive capacity of the tax payer, as stated in art. 127 al. 2 Swiss Constitution, increases64.

Thirdly, there are consequences in case of bankruptcy as this value would then be subject to realization65. This is understandable since the criteria is the compensation of the creditors.

3.2.

Smart Contract Representing a Legal Contract (or Smart Legal Contracts) ^

In the hypothesis where a smart contract imitates the behaviour of a legal contract that was foreseen as falling under the scope of regulation, it should be renamed a «smart legal contract». We will talk about it in a section beneath. For now, we note that data may reproduce the functioning of law66, but also imitate the content of contract (Infra n°5.1), and even the structure and functioning of a corporation (Infra n°5.2).

3.3.

Smart Contract Representing Property ^

A smart contract may also functionally form some new kind of legal title of property. In this eventuality, the smart contract is called a token, which may represent anything. A token is made essentially from lines of computer code saying what it represents67. It can be created unilaterally or multilaterally. Lastly, when the token represents a physical asset, it is often referred as «smart property»68.

From a legal point of view, we must look at whether a token represents a title. Then, we must evawate whether smart contracts or data can represent a title of property with regards to all things, i.e. immovable, movable, or rights. In this section, we call token a smart contract representing a title of property.

3.3.1.

A Title? ^

Titles are mostly developed in the context of debt obligations69. It can be defined as «un agent d’information manifestant une idée de son auteur relevant du droit privé»70. It does not necessarily require to be written and it can even be dematerialized71. Further, according to the doctrine, the notion of title encompasses titles requiring a technical means of accessing it: «Der Urkunden begrifft auch Träger, deren Erklärungsinhalt nur mittels technischer Hilfsmittel zugänglich gemacht werden kann»72, and also electronic data carrier73.

This definition of «agent of information», which relates to private law, fits for the data registered on Blockchain. However, due to the numerus clausus of property rights74, those titles can only be recognized as the existence of a right to access the data, that is the token. Indeed, it is not the role of private parties to define what is property. Then, the legal effects of such a title would only be evidentiary, as it is legally non-binding. The situation could be different when a token is deemed to represent a debt obligation or a corporate stock75. However, we focus here on tokens representing property-like rights.

The form adopted by smart contracts or tokens does not fit in today’s legal framework76. However, we can still draw parallels with similar existing forms77. For instance, the token could be brought nearer to the notion of securities («papier-valeur») in the sense of art. 965 SCO78. According to this hypothesis, a token could eventually represent a security since there is no numerus clausus for securities as long as it satisfies «tout titre muni d’une clause de présentation double»79. Last but not least, the specificity of securities resides in the impossibility to exercise the incorporated right or to transfer it independently from the title80. The transfers of the property for security is foreseen by art. 922 SCC, which states that the transfers occur by giving the means to pass it under its power81.

However, as stated above, securities, even though they are accepted for a multitude of use82, do not and cannot represent valid property rights. At best, the token represents a right to access the title, which represents smart property and over which no legal property rights can be deduced. Hence, the acquirer of the token takes the risk that someone may have a superior right over the represented object. Further, the underlying physical (or immaterial) asset could actually be transferred off-chain, independently from the token (title), which is sufficient to lead us away from the analogy of tokens being securities in the legal sense (art. 965 SCO). Nevertheless, the example of securities is especially interesting regarding recent legal developments. In this vein, the law recently created a new concept of dematerialized securities in the FISA.

According to the FISA, intermediary titles are «neither things, nor debt obligation»83 but they are protected «as if they were the property» of the investors and are considered as sui generis patrimonial rights by the Swiss Federal Court84. The intermediary titles are subject to a «little rei vindication»85, which takes the form of a credit to restitution86. The protection has erga omnes effects (art. 3 II FISA), although it does not overcome an eventual preferential property right87. Finally, art. 3 I FISA limits the types of possible intermediary titles to either debt obligations or fungible social rights88. Eventually, the FISA could inspire the legislators in the creation of Blockchain’s regulation. However, the biggest issue relies in the fact that the notion of «intermediary» is still a central element of this regulation (art. 4 FISA)89, through it’s notion hardly fits with Blockchain90.

3.3.2.

Representing an Immovable ^

The representation of an immovable property by a token is possible, but not used often. From a legal perspective, this dematerialization is not legally possible. Indeed, usually the matters relating to immovable property are solely confined within the sovereign power of the State (see art. 1 let. d Ordinance on Land Registry [ORF])91.

Two similar existing institutions would be the land registry for the registration of property and the mortgage note («cédule hypothécaire», art. 793 SCC) for the title. Nevertheless, as of today’s state of law, first, a title of property cannot be created because of the numerus clausus of the civil rights. And second, the authentic forms required by law for the registration and transfer of ownership of immovables would probably make such a title legally inexistent. Consequently, we facing a sui generis title, which constitutes only an evidentiary document without legal effects92.

Finally, if the law were to recognize some legal effects to such a title in the future, it would seem logical that it would require a notary to draft it in an authentic form. Further, we believe the creation of such a token should be only granted to certain limited authorities. Notably, with regards to what is foreseen in the current legislation for international transfer of immovables93.

3.3.3.

Representing a Movable ^

The token may also represent a movable. In this case, the law should provide more leeway for solutions than with immovables, as it fits with the general trend of dematerialization of rights and movable things. From a regulatory point of view, we should differentiate whether the token actually represents a title of property or a title representing a merchandise since the law prescribes two different regimes for them.

In the first case, the representation of propriety rights within securities follows the same reasoning as seen above. There are no property or property-like rights created, except when the law explicitly permits it (as in the FISA). Further, we could deduce from art. 715 SCC, which is imperative, that such a creation of property would also require the authentic form. Consequently, we are facing here a sui generis title, which only constitutes an evidentiary document without legal effects. However, the contractual parties would still be bound under the perspective of contract law, but the title would have no effects against third parties.

The second interesting institution is the title representative of the merchandise under art. 1153 SCO ff. This title does not actually represent a property right over the merchandise, but serves the «same function»94, as they are at the «service du transports des biens: ils permettent leur transfert et leur mise en gage»95. Further, there is no numerus clausus for those titles, which are only required to meet the conditions of art. 1153 SCO96. In case these requirements are not met, the title is considered a delivery note or an evidentiary title (art. 1155 I SCO). However, such a token could only be considered as a title representing a merchandise when it takes place in the context of transportation.

Our opinion is that the legislator should create a specific category for smart contracts representing movables. It could notably find some inspiration in the FISA’s system. Further, there is an interest in regulating, since the advantages could highly enhance trading. Furthermore, for now the situation is unsatisfactory since the transfer of a token could either not grant ownership on the underlying assets, and acquirers take the risk of having someone claiming the object thanks to a superior right, or it could be legally inexistent.

3.3.4.

Legal Consequences ^

First of all, as stated above (see supra nº3.1.3. ii) b)), the qualification of a token as a valid element of property right could create a statute of assets, which triggers tax and bankruptcy consequences.

Second, the eventual contractual relationships may, according to their agreement, give a possible claim to civil damages via contract law. Notably, in the cases relating to dispositive law, the parties of a smart contract can always contractually prevent abusive effects97, even though this protection would be ineffective against third parties.

Third, regarding property rights: as the token creates an appearance of property we can wonder whether the real owner of the underlying asset should have a right to rectification of the register (Blockchain)98? This can be motivated since there is a general interest in maintaining correct records of property and probably a personal interest for the real owner of the thing.

3.4.

Smart Contract Representing Rights ^

Due to the lengths of this contribution, we won’t discuss much this section. We however wish to highlight this important category of tokens representing rights, be it securities, debt obligations, right-value, or else. The recent surges of ICO and the constant dematerialization of rights have urged jurists to answer this phenomenon.

From a legal perspective, the form adopted by smart contracts or tokens does not fit in today’s legal framework99. As seen above for smart property, in most hypothesises, the right embedded in a token does not fulfil the formal requirements100 of the law and also could actually be transferred independently from the token (title), which is, in this latter case, also sufficient to lead us away from the idea of tokens meeting the legal conditions of being securities (art. 965 SCO) in the legal sense – evven though they may functionally have the same effects. However, we could imagine some hypothesises where a token could be equivalent to an acknowledgement of indebtedness according to art. 82 Federal Act on Bankruptcy101.

Further, this section gives us the opportunity to draw a parallel between token and today’s regulation of right-value («droit-valeur», art. 973c SCO), which is the latest example of dematerialization and fits at the boundary of obligation and property rights102. A right-value has the «same function as securities» (art. 965 SCO)103. Like token, right-values are not attached to things on which property right can be exercised104. Indeed, they are necessarily nominative and may represent either a societal right or a debt obligation. The regimes of right-value depends on whether they fall under the rules of art. 973c SCO105 or the FISA (art. 3 FISA and art. 6 FISA). In this paragraph, we focus on the first occurrence since it does not necessarily require a financial intermediary. In those cases, the right-value is created though a constitutive inscription in a private register hold by the debtor of the right106. Eventually, this notion of right-value could inspire the legislator to regulate the recognition of certain rights embedded in a token.

4.

Applicable Law & Jurisdiction ^

The primordial questions, notably in those cases with a foreign element, are, which which law is to be applied and where the competent jurisdiction is.107 Indeed, the applicable law may have a crucial effect on the validity of the smart legal contract. In this vein, the section 44-7061 C of the Arizona revised statute provides an interesting answer. First, it gave a legal existence to smart contracts on a Blockchain, which is equated to an electronic record. In particular, this norm acknowledges smart contracts by giving them legal effects in spite of their specific format. Notably, it states that a «smart contract cannot be denied legal effect, validity or enforceability solely because it contains smart contract terms». This element is crucial since, if the applicable law does not recognize the contract as valid, the whole agreement is unenforceable.

Firstly, regarding the ratione loci, most of the time, smart legal contracts do not contain any reference in favour of a legal forum in their computer code or elsewhere108. Nevertheless, defendants can most of the time consider the place of their domicile109, or the place where the performance must take or must have taken place110 as one of the possible alternative competent jurisdictions where legal actions can be introduced.

Further, the competent jurisdiction might also depend on the objects of the smart contract. For instance, if a token were to represent an immovable property, then it would trigger the imperious competence of the jurisdiction where the building is situated111. Furthermore, jurisdiction might also depend on the type of parties, for instance if one of the party is considered as a consumer112 or an insurance company113 or maybe investors. In this regard, the recent Tezos’ case should bring interesting answers114.

Secondly, the ratione materiae, or which law is to be applied? According to the Federal Act on International Private Law (PILA)115, the rule is to consider the national law the contract has the closest relation with116. Presumably, the closest law is the one of the domicile of the party which must perform the main obligation117.

Finally, the recent surges of ICO, and the ban of several nationalities, notably U.S. citizens, from the bidding pools, or the recent cryptocurrency ban made by China, highlights this problem and gives an incentive to forum shopping.

5.1.1.

Foreword ^

In this section, we wish to assess some selected aspects of smart legal contracts in a more detailed way.

5.1.2.

General Legal Requirements ^

According to Swiss law, there are four conditions to create a legally enforceable contract:

- two or more parties

- manifestation of will;

- exchange of will;

- concordance of will.

5.1.3.

Parties ^

The first condition is already problematic with regards to smart contracts. Indeed, the parties to the smart contract are actually represented by an address, which creates difficulties to identify the other counterparty, since it is identified by a sequential number118. This is problematic, since a legal contract might require some specific representative as counterparty (e.g. corporation’s representative) or simply a person with full legal capacity. For instance, on Ethereum, anyone can open an account without proving either of those qualities. Further, depending on the hypothesis, the human counterparty might even be very remote under a chain of smart contracts. Consequently, it is easy to imagine a smart contract where the parties involved might not recognize or do not know their counterparty.

Our opinion is that best practices should be developed. First, smart legal contracts should mandatorily contain the name of the counterpart and platforms should enable efficient identification processes. Further, we should admit that only as long as we can trace back the counterparty to a legal entity or a legal person, the smart contract is to be considered as validly concluded119.

5.1.4.

Consent, Exchange of Will and Concordance ^

The second question relates to the consent. In relation to smart contracts, consent is manifested by signing the transaction cryptographically. The form of the consent is not really the problem120, the issue rather lies in the fact that computer code is an opaque language to most human beings121. From a legal perspective, the question of understanding opaque language is often bridged with the form of consent given with a click-wrap agreement. Nevertheless, the answers regarding their validity before the courts are still unclear122.

In the first scenario, the computer code is still the best proof that a legal relationship occurred between the two parties. This situation is not ideal since it is unclear whether the clauses and the contract were well understood by both parties, but according to freedom of the form, the contract itself should still be accepted as valid123. In cases of an uncertainty regarding the content, we should apply the rules of art. 18 SCO and interprete the will of the parties, and in case of non-concordance124, declare the nullity upon the clauses without consensus125. Finally, we note that, in this scenario, the whole process of offer, acceptance and the existence of the consent takes place only in the virtual world that is the Blockchain126.

The second scenario refers to more traditional means of law. This oral or paper version of the smart legal contract should be considered as hierarchically superior to what the computer code executes, similarly to what is retained for the interpretation of click-wrap agreements with regards to the main contract127. In our view, this co-existence with an off-chain contract should become a best practice whenever the contract reaches a certain importance. Additionally, it is quite easy to automatically compile a smart contract into a human readable language128. In this way, parties can truly ensure that consent was given over the specific content of the contract.

Regarding the exchange of intention, we consider that in order to fulfil this requirement, the parties must have both signed the transaction, i.e. the smart contract, cryptographically129. Otherwise, in cases where only one signature is provided, we should consider that there is no consensus, hence no bilateral contract. With regards to the moment of conclusion, it shall be considered concluded from the moment when the smart contract was cryptographically signed by both parties, and not when it is registered on the Blockchain.

Finally, we can mention that the question of the time of acceptance might be important. Notably, in the scenario of an ICO where the moment of registration on the Blockchain is heavily delayed or never occurs, e.g. because miners refuse to process a transaction, we should still consider that a valid legal contract has taken place.

5.1.5.

Formal Requirements ^

The contractual law knows the principle of informality (art. 11 SCO). Consequently, it is sufficient when the consensus between the parties is recognizable and comprehensible130. The written form supposes a document signed by the concerned persons (art.13 SCO), with the format of the signatures being regulated by art. 14 f. SCO, and ultimately by the Federal Law on Electronic Signatures (SCSE)131.

Regarding smart contracts, we can say that the cryptographic signature provided by the parties shall generally not be considered as equivalent to the electronic qualified signature as presented in art. 14 al. 2bis SCO132. The main reason is that it does not usually fulfil art. 2 al. 1 lit. e SCSE. Consequently, smart contracts are not equivalent to contracts in written form133.

5.1.6.

Object ^

Another aspect we wish to mention is the object of transaction. As already highlighted, one of the effects of the Blockchain is to crystalize the computer code by making it immutable. This effect is particularly problematic regarding the system of protection of the law with regards to invalid or illicit contract136. For instance, whenever a smart contract has an illicit object, or does not gather all essentiali negotii137, or is non-compliant with formal requirements, or even a clausula rebus sic stantibus occurs. The problem is that a smart legal contract can enforce an illegal obligation, without the possibility for a judge or anyone to disable it. Thus, the absence of such rescission mechanisms within the smart contract’s code could be potentially harmful, since the smart contract would be simply considered legally non-binding.

Still, some technical solutions exist to prevent this impasse. The first one, and the most obvious, is the destruction of the smart contract via the so-called selfdestruct function. This enables to destroy the contract, which might not be very proportionate with regards to the problems encountered. That is why other functions exist, such as the callcode, enums or else, that can alter the content of the computer code in a more specific manner. For instance, there is the idea of a function being used as a back-up address that enables a rescission of the computer code of the smart contract directly by a legal court very interesting138. This would enable the court to act directly on a smart contract in case of need, and give them the statute of «Oracle», acting as a legitimate resolution mechanism for technical and juridical issues.

5.3.

Corporation ^

The stacking together of smart contracts might, factually, represent a corporation139. Depending on their specific forms, it may resemble either a collective investment scheme, or a form of corporation. The law requires mandatorily conditions, such as the authentic form or a registration to a trade register, or the approval by the FINMA (art. 15I let. a Federal Act on Collective Investment Schemes [LPCC]140), to be legally valid.

Consequently, as most of the smart contracts have no existence off-chain, and are not registered by the trade register, the general solution would be to consider those kinds of stacked smart contracts as constituting an ordinary partnership (530 ff. SCO)141, with all the legal consequences it generates.

6.

Non-contractual Liabilities ^

Probably one of the most fascinating issue to be developed regarding smart contracts and Blockchain is the need for a non-contractual liability based on art. 41 SCO, with regards to peripheral actors of the Blockchain (e.g. exchanges, miners, oracles, Blockchain developers,…)142. Should we consider all the full nodes composing the Blockchain as part of a single depository143? Is there a right to have the register, i.e. the Blockchain, changed and to require a fork144? Is there a liability for free software?

We won’t develop those issues in any detail here. However, we can highlight that the law truly faces challenges. Indeed, the main issues relate to the visions of the law. Usually, liability is with the intermediaries, as it was for the Internet145. In the case of Blockchain, this concept must be completely rethought, because there are no more intermediaries. Or rather, there are, but it would be unfair to impose liability on them, which would force developers to rethink the functioning of Blockchain completely146.

IV.

Conclusion ^

In conclusion, this paper assessed several issues. First, we saw that smart contracts are legally relevant whenever the raison d’être of the law can be met. Second, we differentiate smart contracts and place them according to legal categories. We found in particular that smart legal contracts are subject to the application of contract law and corporate law. However, the use of smart contracts in order to create a property-like right, i.e. smart property, cannot be legally recognized for now. Thirdly, we had an overview over the questions of applicable law and jurisdiction. We found that this question is very central with regards to smart contracts and, as of today’s state of the law, it lacks certainty.

Eventually, the ecosystem of smart contracts and Blockchain will highly benefit from the application of the law, and vice versa. Hence, we jurists should begin to develop a casuistic about the specific problematic brought by those technologies and construct some legally compliant solutions. We advocate for the incorporation of smart contacts and Blockchain under the aegis of the law. In this sense, we would be able to create some new legal fiction and develop the concept of the title of property-like. Further, we should ensure that the validity and the effect of smart legal contracts is protected by the law. Last but not least, smart contract drafters shall be encouraged to work along the legal side. In the opposite case, and if an economy of non-compliant or rogue smart contracts is developed, the backlash of the regulation could be disastrous for the whole industry.

M. Gabriel Jaccard is a PhD candidate at the University of Geneva, Switzerland.

- 1 James Hazard/Helena Haapio, Wise Contracts: Smart Contracts that Work for People and Machines, in: Erich Schweighofer/Franz Kummer/Walter Hötzendorfer/Christoph Sorge (eds.), Trends und Communities der Rechtsinformatik / Trends and Communities of Legal Informatics, Tagungsband des 20. Internationalen Rechtsinformatik Symposions IRIS 2017, 2017, p. 2 ff. With regards to the coding of legal prose in general.

- 2 Paul-Henri Steinauer, L’informatique et l’application du droit, thèse, Editions Universitaires, Fribourg 1975.

- 3 https://www.ethereum.org (all websites were last accessed on 10 November 2017)

- 4 E.g. Chris Dannen, Introducing Ethereum and Solidity – Foundations of Cryptocurrency and Blockchain Programming for Beginners, Apress 2017.

- 5 Stephan D. Meyer/Benedikt Schuppli, «Smart contracts» und deren Einordnung in das schweizerische Vertragsrecht, in: recht – Zeitschrift für juristische Weiterbildung und Praxis, p. 207 s.

- 6 See, https://www.coindesk.com/making-sense-smart-contracts/.

- 7 N.b. the only piece of legislation (Arizona, U.S, HB 2417) in our knowledge defining smart contracts takes the following approach: «[A smart contract is an] event driven program, with state, that runs on a distributed, decentralized, shared and replicated ledger that can take custody over and instruct transfer of assets on that ledger.»

- 8 Nick Szabo, A Formal Language for Analyzing Contracts, 2002, http://nakamotoinstitute.org/contract-language/.

- 9 Jana Essebier/Dominic A. Wyss, Von der Blockchain zu Smart Contracts, in: Jusletter 24. April 2017, p. 8 ff.

- 10 N.b.a. contract can have account on Ethereum’s platform too. See http://ethdocs.org/en/latest/contracts-and-transactions/account-types-gas-and-transactions.html.

- 11 Ari Juels/Ahmed Kosba/Elaine Shi, The Ring of Gyges: Investigating the Future of Criminal Smart Contract, CCS 2016.

- 12 Essebier/Wyss (note 9), p. 2; Luca Bianchi/Edi Bollinger, A (Legal) Perspective on Blockchain, in: CapLaw-2016-47, p. 3; Mirjam Eggen, Chain of Contracts, in: AJP 2017, p. 4.

- 13 As heard during the Swiss legal Tech Conference 2017, some authors consider Blockchain as one of the elements of definition of smart contracts.

- 14 Jörn Erbguth, Lösung Blockchain-basierter Konflikte, in: Schweighofer/Kummer/Hötzendorfer/Sorge (note 1), p. 2 ff.

- 15 In comparison, do you think that the Swiss land register will still exist in 100 years?

- 16 Ari Juels/Bill Marino, Setting Standards for Altering and Undoing Smart Contracts, in: Jose Julio Alferes/Leopoldo Bertossi/Guido Governatori/Paul Fodor/Dumitru Roman (eds.), Rule Technologies. Research, Tools, and Applications – Proceedings of the 10th International Symposium, RuleML 2016, 2015, p. 151 s.

- 17 Julia Black, Critical Reflections on Regulation, in: Australian Journal of Legal Philosophy, 2002, p. 26.

- 18 Christoph B. Graber, Internet Creativity, Communicative Freedom and a Constitutional Rights Theory Response to «Code is Law», in: Sean Pager/Adam Candeub (eds.), Transnational Culture in the Internet Age, Edward Elgar Publishing 2010, p. 135 s.

- 19 We can wonder whether, under the optic of the Blockchain’s normativity, the computer code of a smart contract, when registered on a Blockchain, represents a primary rule over law in this case, according to Hart’s concept of rules (H.L.A. Hart, The Concept of Law, in: Oxford University Press, 1961)? Notably, because the computer code might be enforced regardless of the consideration of the law.

- 20 Meyer/Schuppli (note 5), p. 210: quoting Vlad Zamfir «Society has never created something that is not human in order to govern society».

- 21 RS 210.

- 22 Loose translation: «The law applies according to its wording or interpretation to all legal questions for which it contains a provision.»

- 23 Morin, in: Luc Thévenoz/Franz Werro (eds.), Commentaire Romand, Code des obligations I, Bâle 2012, Art. 1 N 13 and N 63, quoting Marc Amstutz (hereafter «CR-CO I-Author, Art. X»).

- 24 CR-CO I-Morin, Art. 1, N 1 ff.

- 25 On the opposite: «Cette faculté d’objectivation des valeurs fait de la Blockchain un lieu virtuel sur lequel il est possible de ‹faire pousser› du droit, autonome du droit positif des Etats.» https://Blockchainfrance.net/2017/09/19/Blockchain-et-droit/amp/.

- 26 Lawrence Lessig, Code, and Other Laws of Cyberspace, New York 1999, p. 6.

- 27 See infra, nºIII.2.

- 28 See: https://www.finma.ch/en/news/2017/09/20170929-mm-ico/; https://www.sec.gov/news/press-release/2017-131; https://www.fca.org.uk/news/statements/initial-coin-offerings.

- 29 See: http://hackingdistributed.com/2016/06/18/analysis-of-the-dao-exploit/.

- 30 E.g. a Bitcoin is worth $7’000.–.

- 31 Is personal data worth the 1/100 chance to win an iPhone?

- 32 Meyer/Schuppli (note 5), p. 217.

- 33 Florent Thouvenin/Alfred Früh/Alexandre Lombard, Eigentum an Sachdaten: Eine Standortbestimmung, in: SZW 20017.

- 34 Thomas Linder/Christoph Rechsteiner/Stephan D. Meyer, Die steuerliche Behandlung von Bitcoin und anderen Kryptowährungen, 2017, p. 8, https://www.mme.ch/de/magazin/wie_muessen_bitcoins_deklariert_werden/; and Luka Müller-Studer/Stephan D. Meyer/Christine Gschwend/Peter Henschel, Conceptual Framework for Legal & Risk Assessment of Blockchain Crypto Property (BCP), 2017, https://www.mme.ch/fileadmin/files/documents/Publikationen/170927_Magazinbeitrag_BCP_Genesis_Version.pdf.

- 35 Meyer/Schuppli (note 5), p. 219 ff.

- 36 Yaniv Benhamou/Laurent Tran, Circulations des biens numériques: de la commercialisation à la portabilité, in: sic! 2016, p. 582. See also Meyer/Schuppli (note 5).

- 37 Thouvenin/Früh/Lombard (note 33); Sébastien Gobat, Les monnaies virtuelles à l’épreuve de la LP, in: PJA 2016, p. 1098.

- 38 Müller-Studer/Meyer/Gschwend/Henschel (note 34), p. 2.

- 39 «Notwithstanding any other law, a person that, in or affecting interstate or foreign commerce, uses Blockchain technology to secure information that the person owns or has the right to use retains rights of ownership or use with respect to that information as before the person secured the information using Blockchain technology», Section 44-7061, Arizona revised Statutes, Bill HB 2417.

- 40 Indeed, the value of, e.g., a token only exists within its system (Blockchain). E.g. Benhamou/Tran (note 36), p. 575 f.

- 41 Art. 919 SCC requires a possession over a «thing». The creation of the statute of possessors when you own the private key would be problematic as it can be easily duplicated, hence creating an important number of possessors.

- 42 Sevan Antreysan, Réseaux sociaux et mondes virtuels, Thèse de doctorat: Univ. Genève 2016, N 58: «L’utilisateur ne possède donc pas matériellement le bien virtuel. Il ne dispose que du droit d’y accéder»; Herbert Zech, Data as a Tradeable Commodity – Implication for contract law, in: Josef Drexl (ed.), Proceedings of the 18th EIPIN Congress: The New Data Economy between Data Ownership, Privacy and Safeguarding Competition, Edward Elgar Publishing 2017, p. 6: «Regarding data – just like any other information good – there is no possession, only access. Unlike possession, access is not necessarily exclusive. Therefore, access is not transferred but only granted»; See also, Jeanne L. Schroeder, Bitcoin and the Uniform Commercial Code, 24 U. Miami Bus. L. Rev. 1 2016, p. 19 ff.

- 43 RS 957.1.

- 44 E.g. Switzerland in Geneva’s trade register: https://www.ge.ch/dossier/geneve-numerique/Blockchain; Sweden’s land register: https://qz.com/947064/sweden-is-turning-a-Blockchain-powered-land-registry-into-a-reality/.

- 45 As the Vermont and Arizona’s law did.

- 46 See the answer of the Federal Council to a parliamentary motion regarding Blockchain’s use: «Il s’agit notamment d’élucider la qualification juridique des avoirs virtuels et de vérifier l’applicabilité et l’adéquation de la réglementation actuelle», https://www.parlament.ch/fr/ratsbetrieb/suche-curia-vista/geschaeft?AffairId=20173818.

- 47 https://www.ethereum.org/greeter.

- 48 RS 311.

- 49 Thouvenin/Früh/Lombard (note 33), p. 33.

- 50 N.b. the classification of data under the definition of virtual / digital / smart, property / asset remains elusive. Digital property also sometimes refers to a subcategory of virtual property. In our view, what is important is to distinguish that virtual property is fully simulated and cannot be used to buy «real» goods and services. https://bitcoinmagazine.com/articles/digital-vs-virtual-currencies-1408735507/.

- 51 Further, we can imagine situations where there would be no markets but where the law, via the judgement of a court, recognizes a concrete fiat value in a certain situation. In this hypothesis, the virtual property becomes actually a data protected by law.

- 52 https://fr.wikipedia.org/wiki/Les_Sims.

- 53 Here again, the terms virtual / digital / (crypto-)currencies / money are often mixed. See above, note 47.

- 54 Rapport du Conseil fédéral sur les monnaies virtuelles en réponse aux postulats Schwaab (13.3687) et Weibel (13.4070) du 25 juin 2014, p. 8 (hereafter «Report CF 2014»).

- 55 The notion of a market that concretizes an immaterial value already exists when considered at large. For instance, the sentimental value that is recognized juridically, e.g. if two children A and B wish to acquire a single painting representing their childhood from their father. Imagine the monetary value of the painting is $10, but A is willing to pay $40 and B $45. We can then assess an immaterial value of the painting that is at least $35 higher than the objective value, which is a potential acquisition price. The difference of $35 represents a subjective immaterial value. See also, Benoît Chappuis, Le moment du dommage, Schulthess 2007, p. 34, p. 38 ff.

- 56 N.b. Bitcoin is often compared with currency. Indeed, it appears it passes all economics tests for it (see https://cointelegraph.com/news/does-bitcoin-meet-the-test-for-being-money). From our point of view, the sole missing element is legal legitimacy. If we can compare the economical use of Bitcoin and Swiss francs, one is acknowledged by law (art. 99 Swiss Constitution).

- 57 N.b. Ethers (from Ethereum) are often referred to as «crypto-commodity» because the fees (or fuel) of transactions that is paid in Ether.

- 58 Gobat (note 37), p. 1098.

- 59 Chappuis (note 55), p. 34.

- 60 Roland Brehm, in: Berner Kommentar – Art. 1–183 OR. Allgemeine Bestimmungen, Stämpfli 1945, Art. 1 N 70; Chappuis (note 55), p. 21 ff., p. 25. Further, it could notably be sold. See also a jurisprudence regarding WIR: ATF 102 II 339.

- 61 RS 220.

- 62 Meyer/Schuppli (note 5), p. 221 ff.

- 63 Linder/Rechsteiner/Meyer (note 34).

- 64 For convenient purpose, maybe the law should set a minimal amount to reach before the tax payer must declare its fortune.

- 65 Gobat (note 37), p. 1100; Barbara Graham-Siegenthaler/Andreas Furrer, The Position of Blockchain Technology and Bitcoin in Swiss Law, in: Jusletter 8. Mai 2017; Judgement of the Federal Supreme Court 5C.268/2002 of 14 February 2003 consid. 2.3; See also the U.S. jurisprudence Re Hashfast Technologies LLC, where Bitcoin is considered as Property under U.S. Bankruptcy Code. The case also rules that the amount of Bitcoin may be recovered at its judging present day appreciated value.

- 66 See Steinauer (note 2).

- 67 https://ethereum.org/token.

- 68 Eggen (note 12), p. 6.

- 69 Bohnet, in: Pierre Tercier/Marc Amstutz/Rita Trigo-Trindade (eds.), Commentaire Romand, Code des obligations II, Basel 2017, Art. 965–973c N 9 ff. (hereafter «CR-CO II-Author, Art. X).

- 70 Furter, in: Heinrich Honsell/Nedim Peter Vogt/Rolf Watter (eds.), Basler Kommentar Obligationenrecht II, Helbing Lichtenhahn Verlag 2016, Art. 965–1155, N 2.

- 71 CR-CO II-Bohnet, Art. 965–973c, N 3 f.

- 72 Arthur Meier-Hayoz/Hans Caspar Von der Crone, Wertpapierrecht, 2. Aufl., Stämpfli 2000, N 7.

- 73 Meier-Hayoz/Von der Crone (note 72), N 9 ff.

- 74 Meier-Hayoz/Von der Crone (note 72), N 19 ff.

- 75 Michel José Reymond/Aline Darbellay, Emissions et négoces de jetons digitaux, in: EF 11/17.

- 76 Reymond/Darbellay (note 75), p. 882.

- 77 Erbguth (note 14), p. 3 f.

- 78 Eggen (note 12), p. 6.

- 79 CR-CO II-Bohnet, Art. 965, N 13.

- 80 CR-CO II-Bohnet, Art. 965, N 6.

- 81 «La possession se transfère par la remise à l’acquéreur de la chose même ou des moyens qui la font passer en sa puissance».

- 82 CR-CO II-Bohnet, Art. 965, N 19.

- 83 CR-CO II-Eigenmann/Thévenoz, Intro FISA, N 67.

- 84 ATF 138 III 137.

- 85 CR-CO II-Eigenmann/Thévenoz, Intro FISA, N 103.

- 86 Idem.

- 87 CR-CO II-Eigenmann/Thévenoz, Intro FISA, N 107.

- 88 CR-CO II-Eigenmann/Thévenoz, Intro FISA, N 71 ff.

- 89 CR-CO II-Eigenmann/Thévenoz, Intro FISA, N 124 ff., N 129.

- 90 Note, however, that this could be different with consortium Blockchain or permissioned Blockchain, since the participants are usually known.

- 91 RS 211.432.1.

- 92 See Eggen (note 12), p. 7 f.

- 93 E.g. via the Federal Law on the Acquisition of Real Estate by Foreign Nationals, RS 211.412.41. See also, CR-CO II-Bohnet, Art. 965, N 34. Notably regarding the reason, the FISA was introduced at first.

- 94 Meier-Hayoz/Von der Crone (note 72), N 21.

- 95 CR-CO II-Eigenmann, Art. 1153 N 1.

- 96 CR-CO II-Eigenmann, Art. 1153 N 5.

- 97 «Le bien numérique peut aussi être protégé par le droit des contrats, en particulier celui qui n’est protégé par aucune loi spéciale et ne fait l’objet d’aucun droit subjectif absolu, mais l’objet d’une maîtrise de fait (p.ex. des secrets d’affaires ou bases de données)», Benhamou/Tran (note 36), p. 574.

- 98 In this sense: Chris Reed/Umamahesh Sathyanarayan/Shuhui Ruan/Justine Collins, Beyond BitCoin – Legal Impurities and Off-chain Assets, Queen Mary School of Law Legal Studies Research Paper No. 260/2017, 2017, p. 18 ff.

- 99 Reymond/Darbellay (note 75), p. 882.

- 100 E.g. art. 793 ff. (799/825) SCO and art. 884 SCO (which requires the possession of the thing).

- 101 RS 281.1.

- 102 CR-CO II-Bohnet/Hänni, Art. 973c N 3.

- 103 CR-CO II-Bohnet/Hänni, Art. 973c N 4.

- 104 Idem.

- 105 CR-CO II-Bohnet/Hänni, Art. 973c N 28.

- 106 CR-CO II-Bohnet/Hänni, Art. 973c N 7 ss (N 18). Note that, if the rights represent the stock of a corporation, further conditions might apply (art. 620 ff. SCO).

- 107 Otherwise, only national law would apply.

- 108 For best practices purposes, smart contracts should contain an ontology of the core contract agreement, see Hazard/Haapio (note 1), p. 5 f.

- 109 See art. 2 PILA, art. 112 PILA; and also art. 2 of the Lugano Convention on Jurisdiction and the Enforcement of Judgments in Civil and Commercial Matters (LugC), RS 0.275.12.

- 110 See art. 113 PILA, art. 5 al.1 LugC.

- 111 E.g. art. 97 PILA, art. 119 PILA.

- 112 See art. 16 LugC, art. 114 PILA, and the UK Unfair Contract Terms Act of 1977.

- 113 See art. 9 al.1 let.b LugC.

- 114 https://www.letemps.ch/economie/2017/11/07/ico-entrent-une-periode-charniere.

- 115 RS 291.

- 116 See art. 117 ff. PILA.

- 117 See art. 4 I let. B of the Regulation (EC) No 593/2008 of the European Parliament and of the Council of 17 June 2008 on the law applicable to contractual obligations (Rome I), and art. 117 PILA.

- 118 Alexander F. Wagner/Rolf H. Weber, Corporate Governance Auf Der Blockchain, in: SZW 2017, p. 69.

- 119 N.B. In a fantasist optic, some artificial intelligence acquire some form of legal personality by the delivery of citizenship (http://www.newsweek.com/tokyo-residency-artificial-intelligence-boy-shibuya-mirai-702382), author rights or even consciousness (e.g. in the movie «Ex Machina», by A. Garland). Maybe in the future, we shall see some forms of contractual statutes for robots. Imagine a software programmed for trading and based on machine learning. In the event, the artificial intelligence develops a strategic method unknown from the trader and buy stocks independently. Is the trader still the contractor?

- 120 CR-CO I-Xoudis, Art. 11 N 78 ff.

- 121 Mark Giancaspro, Is a «Smart Contract» Really a Smart Idea? Insights from a Legal Perspective, in: Computer Law & Security Review: The International Journal of Technology Law and Practice 2017, p. 7.

- 122 This question is sometimes linked with click-wrap agreement’s consent (General terms of use on the Internet).

- 123 In this sense the report over virtual currency: «En effet, recourir à une monnaie virtuelle en tant que moyen de paiement pour l’acquisition de biens ou de services impliquerait nécessairement que les parties aient réciproquement et d’une manière concordante manifesté leur volonté au sens de l’art. 1 CO». See Report CF 2014 (note 54), p. 11; In this sense, also Arizona law: «A contract relating to a transaction may not be denied legal e ect, validity or enforceability solely because that contract contains a smart contract term.»

- 124 Eggen (note 12), p. 8.

- 125 N.b.: Is there a consensus in the Tezos case, where the vendors were saying the ICO collected non-refundable decisions when investors were thinking it was an investment? Do prospectus requirements apply? https://www.letemps.ch/economie/2017/11/07/ico-entrent-une-periode-charniere.

- 126 Eggen (note 12), p. 8.

- 127 See CR-CO I-Winiger, Art. 18 N 1 ff., Giancaspro (note 121), p. 7.

- 128 Hazard/Haapio (note 1), p. 2.

- 129 See also Eggen (note 12), p. 7: «Die Parteien erklären sich aber durch ihre Signatur mit dem Wert einverstanden und setzen dadurch ein starkes Indiz, dass sie zu diesem Zeitpunkt auch über den Vertragsinhalt einig sind.»

- 130 CR-CO I-Xoudis, Art. 11 N 9.

- 131 RS 943.03.

- 132 Wagner/Weber (note 118), p. 69

- 133 CR-CO I-Xoudis, Art. 13 N 6; Eggen (note 12), p. 8.

- 134 See also Eggen (note 12), p. 8

- 135 CR-CO I-Xoudis, Art. 16 N 2.

- 136 Erbguth (note 14), p. 5.

- 137 Claire Huguenin, Obligationenrecht, 2014, N 256 ff.

- 138 Juels/Marino (note 16), point N 2.4.

- 139 E.g. the DAO.

- 140 RS 951.31.

- 141 CR-CO II-Chaix, Art. 530 N 21; see also Erbguth (note 14), p. 4.

- 142 Further on Meyer/Schuppli (note 5), p. 210 ff. Should we look at the owner of bitcoin.org, who display a large disclaimer as «not being an authority»?

- 143 «Die Miner, ohne die das Netzwerk nicht funktionieren würde, [müssen] als ein Zusammenschluss von mehreren natürlichen (und juristischen) Personen verstanden werden.» Meyer/Schuppli (note 5), p. 223.

- 144 See Erbguth (note 14), p. 3 f.; Definition of Hard Fork: https://www.investopedia.com/terms/h/hard-fork.asp.

- 145 Julien Francey, La responsabilité délictuelle des fournisseurs d’hébergement et d’accès Internet, Schulthess 2017.

- 146 For instance, creation of funds alimentated by a supplementary fee on transactions may constitute a viable solution to indemnify against liabilities.