1.

Introduction ^

A simple joint-stock company (simple JSC), a new type of capital company for start-ups, or the dematerialisation of non-public debt securities such as bonds are both the crucial examples of changes in the Polish commercial law that take into account the widespread use of innovative IT solutions. The analysed examples of changes in the Polish commercial law indicate that 2019 and 2020 may be breakthrough years for the Polish commercial law regulations, consistent with European Union legislation, particularly from the perspective of the foreign investors operating in the Polish financial markets and investing in Polish start-ups.

2.

Two examples of recent changes in the Polish commercial regulations ^

The new regulations implement IT procedures in the securities market as well as procedures related to new legal forms of establishing start-ups. The chance for a breakthrough in the analysed areas concerns not only the discussed examples of already adopted changes that are now in force in Poland but also those awaiting implementation. Modern IT solutions also provide for an amendment that is at present at the stage of Polish parliamentary work. The latter relate to the amended Act on bonds1 and the Code of Commercial Companies2 and more specifically the amendments to said acts of law, one of which comes into force on 1 July 20193 and the second was passed to the Polish Sejm to work on the draft assumed to enter into force on 1 March 20204.

3.

Case 1: new «pro-investors» regulations in the Polish law of financial markets ^

The aforementioned amendment to the Act on bonds is a part of a wider commercial reform, the purpose of which is to strengthen the supervision of the financial markets through one amendment to as many as 22 acts of law, including, inter alia, the Act on Trading in Financial Instruments5. This very important reform from the perspective of foreign investors introduces a number of changes aimed at the computerization of the securities market. It introduces, among others, changes in the rules for issuing corporate bonds, issuing investment certificates and mortgage bonds.

4.

Case 2: amendments to Polish company law – establishing a simple JSC online ^

The second example of the Polish commercial law reform cited above is an equal breakthrough. This amended regulation is manifested in the new provisions to the Polish Code of Commercial Companies. It concerns the core of business transactions from the perspective of modern cross-border investment practices into new business operations in Poland. The amendment creates a new legal form of operating business based on a start-up formula. The analysed bill provides for the creation of a simple joint-stock company (Polish: Prosta Spółka Akcyjna) (simple JSC), which – next to a limited liability company and a regular joint-stock company – is to be another type of a Polish capital company. A simple JSC is intended primarily for start-ups in technology the sector. The rule is that a start-up business does not typically have enough capital required to set up a classical joint-stock company in Poland. In turn, the available legal form of a Polish limited liability company does not always fully meet the needs of start-ups. Such an assessment results from a study conducted by the Polish Ministry of Enterprise and Technology6. The need of analysed changes is also confirmed by the research of the Polish Agency for Enterprise Development, in which as many as 73% of respondents indicated the need for a new legal formula for innovative companies, namely the creation of a new form of capital company. Thus, these changes are part of the European trend, which consists in creating special legal entities dedicated primarily to start-ups. A simple joint-stock company together with the changes in the area of dematerialization of bonds and other securities, which constitute an important formula of company capitalisation, may introduce a new quality on the Polish capital market, in particular they may contribute to the acceleration and increase of safety of legal procedures taking into account the wider application of IT solutions resulting from speedy technological progress.

5.

Dematerialization of bonds ^

The new legal regulations in Poland make use of the opportunities for the development of information technologies applied in the market of non-public debt securities. The new law allows for the process of so-called dematerialization of bonds and other securities. It is a deviation from the materialized (paper) form of rights attached to securities (in the conventional form) to the electronic form of bonds.7 The act of law introducing the dematerialisation of bonds constitutes the next stage in the wider law-making process that began in 1989 in Poland. The total dematerialization is already in force in the case of trading in shares of public companies on the Warsaw Stock Exchange. This amendment to the Act on Bonds introduces, as of 1 July 2019, obligatory dematerialisation of corporate bonds. The electronic form is also provided for mortgage bonds and investment certificates which are issued by closed-end investment funds. The amendment to article 8, paragraph 1 of the amended Act on Bonds directly states that bonds will not be able to take the form of a document. Additionally, these instruments are subject to registration. This requirement exists regardless of whether such a document is the subject of a public offer. The registration also applies to securities intended for trading in the Alternative Trading System (hereinafter: «ATS»), namely not in the Warsaw Stock Exchange. Pursuant to the second paragraph of said article 8, bonds will be subject to registration in securities depository maintained in accordance with the regulations of the amendment to the Act on Trading in Financial Instruments, i.e. in the National Depository for Securities.

Registration will take place in principle based on the rules that currently apply to public securities and government bonds. Pursuant to the new article 48, paragraph 5e of the Act on Trading in Financial Instruments, the National Depository for Securities shall collect and make available to the public the information about unredeemed bonds, mortgage bonds and investment certificates issued by individual issuers with registered office in the territory of the Republic of Poland. Pursuant to the new provision, the National Depository for Securities also collects information on the extent of liabilities of securities issuers. The resources of the National Depository for Securities will also contain information allowing to determine the scope and timeliness of issuers' performance of their obligations. Such information will be available, for example, to an investor interested in purchasing bonds. Once the entities eligible for the benefits under redemption have been established, the rights from such bonds will not be able to be transferred on other entities. This solution contributes to the security of commercial trading. The above provisions implement the assumptions of EU regulation 909/2014, which in recital 118 state that «The recording of securities in book-entry form is an important step towards increasing the efficiency of settlement and ensuring the integrity of a securities issue, especially in a context of increasing complexity of holding and transfer methods. For reasons of safety, this Regulation provides for the recording in book-entry form of all transferable securities admitted to trading or traded on the trading venues regulated by Directive 2014/65/EU of the European Parliament and of the Council and by Regulation (EU) No 600/2014 of the European Parliament and of the Council».

In the justification to the government bill of amending Act related to the strengthening of supervision over the financial markets and the protection of investors, it was pointed out that the implemented changes are aimed primarily at increasing the transparency of issuing debt securities9. The changes will also improve the security of investors themselves, as the record of bonds will also be supervised by the Polish Financial Supervision Authority. The obligation to register bonds as a document issued by a non-public issuer will lead to greater professionalization, because such securities will be allowed to be registered only by brokerage houses and such banks that have the appropriate license to keep securities accounts.

In connection with the introduction of obligatory dematerialization of bonds, the legislator predicted in the amended article 55 of the Act on bonds that bonds registered in the securities depository kept in accordance with the provisions of the Act on Trading in Financial Instruments provide the right to participate in the bondholders' meeting. The condition is, however, to submit an appropriate deposit certificate to the issuer of the bonds. In this respect, article 9 of the amended Act on Trading in Financial Instruments will apply. According to this provision, such a certificate must be issued in writing, at the request of the holder of the securities account. The certificate confirms the legitimacy to exercise the rights referred to in its contents resulting from the securities held. This solution aims at confirming such rights under the certificate, which cannot be exercised solely on the basis of entries on the securities account, excluding the right to participate in the general meeting.

6.

Bond issue agent ^

Another very important goal of the proposed changes is to facilitate the process of registering bonds and other debt securities. Article 7a introduced to the amended Act on Trading in Financial Instruments, forms an obligatory function of the issuing agent also for private securities (issued by privately-held entities), for which there were no such restrictions before. The said provision states that the issuer concludes a contract for exercising the function of securities issuing agent, either with a custodian bank or with an investment company authorized to keep securities accounts. It is a novelty that the issuer concludes a contract also for securities that are not issued by way of a public offering. Under the new law the subject of a contractual obligation are also securities in respect of which the issuer does not intend to apply for admission to trading on a regulated market or for introduction to the Alternative Trading System. The new provision indicates that the issuer will firstly have to enter into a contract with a brokerage house or a bank authorized to keep securities accounts. In other words, the contract must be concluded with a participant of the National Depository for Securities. This is a contract to perform the functions of the issuing agent. On the basis of such an agreement, a participant of the National Depository for Securities (issuing agent) will create a register of entities entitled to receive securities also in the form of dematerialized bonds.

7.

Agent related to the bond issuer ^

An important change that strengthens financial supervision is the restriction imposed on some securities issuers. Addressees of those new regulations are agents who are investment companies or custodian banks related to a given issuer of securities (the so-called related entities)10.

The amendment therefore introduces additional legal protection aimed at eliminating the conflict of interest. This solution aims to exclude situations that raise doubts as to the ability to properly discharge the obligations of an issuer of debt securities. Cooperation on the line of related entities in the form of: issuer-bond issue agent is admissible by law. However, the contract for exercising the functions of the issuing agent is subject to two conditions. First of all, additional organizational requirements of such related entities should be met. Secondly, there must be obligatory transparency mechanisms for such cooperation.

8.

The legal basis of the issuing agent’s liability ^

The analysed act of law also specifies the tasks and obligations of the issuing agent. These obligations cannot be excluded or limited in the contract for performing the functions of the issuing agent. Pursuant to the new Article 7a paragraph 4 of the Act on Trading in Financial Instruments, the agent’s duties include, among others:

- verification of the issuer’s compliance with the requirements regarding the issue of securities resulting from the provisions of law;

- verification of the issuer’s compliance with the requirements for offering securities resulting from legal provisions;

- verification of the compliance of both the securities and their issuer with the conditions of registration in the securities depository.

The indicated provision directly imposes on the issuing agent the obligation to perform the above-mentioned duties in a reliable and independent manner, with due diligence resulting from the professional nature of the agent’s activities. This will be particularly important in the event of any civil liability arising from non-performance or improper performance of the above-mentioned duties of the agent.

9.

ABC of IT technology used for legal dematerialization of securities ^

The analysed amendment of the legal provisions is dedicated not only to legal processes, but also to technologies that enable the issuer and the investor to secure the dematerialization of their securities, and then ensure their safe storage11.

It is worth emphasizing a number of advantages of dematerialisation, which are mentioned in the literature. This is the effect of seeking a certain alternative to paper documents. Among the advantages mentioned, there is the fact that dematerialisation consists in operation in electronic systems, which is more convenient as compared to conventional forms. It is also emphasized that digitalization leads to facilitation and thus to acceleration of the functioning of each entity (in case of the analysed issue, of the entities dealing in securities).

Only a few years ago, technologies allowing to safely save data from documents did not protect the data in a satisfactory manner. In particular, what has been for a long time pointed out were inadequate solutions in the field of electronic signature from the perspective of cyber security of trading participants. The proper technology should be able to assess whether the signature is authentic, what is crucial especially in the sphere of securities. The digital signature is based on an algorithm that generates a signature when it receives specific data. In the past, public key infrastructure (PKI) was used to achieve this kind of encryption.

10.

PKI encryption ^

The requirements of the new law may be implemented by several technologies whose task is to ensure security in operating systems used also to encrypt data contained in dematerialized securities. There are two groups of encryption: symmetric and asymmetric. The first method consists of using the same secret keys to encrypt the plaintext and decrypt the hidden text, while the second uses two separate keys, one of which is secret (private) and the other open (public). The public key is generally available on the Internet, while the private key is known only to the owner of the key and protected from other persons.

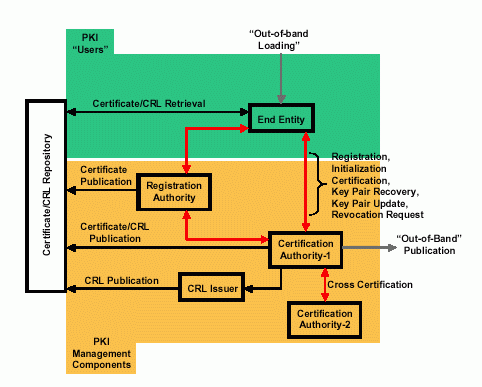

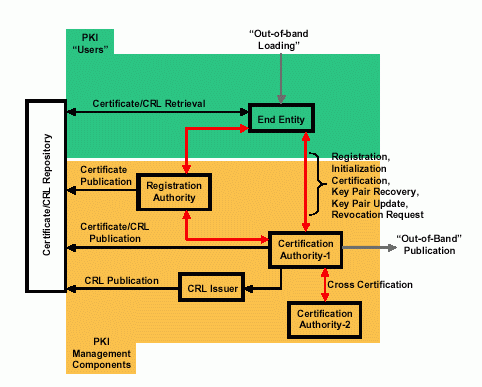

The most well-known and widely used encryption technology is PKI (Public Key Infrastructure). The PKI idea is based on digital certificates, connecting specific participants of the information exchange with the cryptographic keys used in it. The digital certificate is issued by the Certification Authority (CA). When the CA document is issued, it confirms the relationship between the user and the key. The following graphic shows the scheme for the formation of PKI.

Drawing PKI schedule in accordance with PKIX standards.12

11.

New KSI technology ^

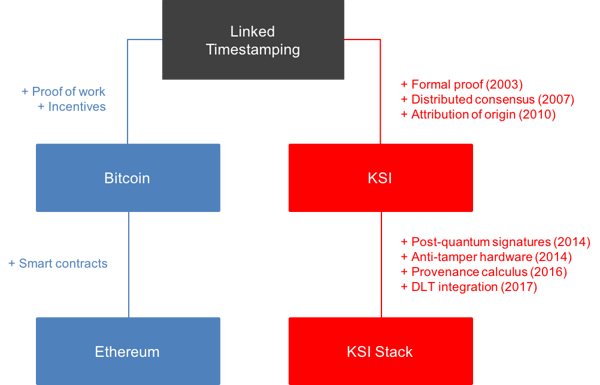

KSI (Keyless Signature Infrastructure) is a new technology that can introduce a new quality in data encryption. It is an alternative to the PKI technology discussed above. Innovations introduced by KSI consist primarily in a distributed (dispersed) infrastructure that enables scaling and virtually eliminating dependencies on cryptographic keys to verify the signatures. KSI is based on blockchain technology. It was created in 2007 and the purpose of its creation was to provide total certainty and efficiency in verifying the authenticity of data. As it is a blockchain-based technology, it provides mass data authentication without relying on centralized trust bodies (as it is the case in PKI)13. In contrast to traditional approaches to a digital signature, e.g. PKI, which depend on asymmetric key cryptography, KSI uses only cryptography with a hash function. Hash function is a function that assigns to an arbitrarily large number such a value which is short, always having a fixed size, non-specific and quasi-random. This function allows to verify the integrity of files or their identification. KSI is a part of the so-called blockchain family. The following graphic14 shows how and when the particular technologies were created over time and where they come from.

PKI and KSI can co-operate, simultaneously complementing each other, for example, PKI can be used for legally binding electronic signatures, while KSI serves to prove that the PKI key was valid at the time of signing and also to verify signed data generated by the machine, such as bank transactions. The leading country in the creation of data repositories, as well as generally in creating and applying information technology in the analysed field is, among others, India, where the popularity of this IT sector is extremely popular (a link to one of the popular science lectures on dematerialization technology available on one of the social networks15).

12.

Legalization of dematerialisation is the need of globalization ^

The described amendment of the Polish law is in line with the global trend, demonstrating the introduction of dematerialisation solutions to the respective jurisdictions. This is due to the fact that the IT revolution has led to the situation in which the modern world departs from securities in a conventional form. It is therefore a phenomenon of a global nature taken into account in the financial laws of individual jurisdictions. The global character of the dematerialization of securities is proved by the legislation of many countries, among which from the perspective of Europe, an interesting example may be that of the legislation of Jamaica in the form of a legal act called The government securities dematerialization act of February 16, 2010, publication number L.N. 92c / 201216. In turn, the potential of the market and the need for legal dematerialization mechanisms is illustrated by the example of the American Depository Trust & Clearing Corporation (DTCC)17. The official economic DTCC indicators indicate that market development is based on securities dematerialization solutions (processing of securities transactions valued at USD 1.6 billion; DTCC securities include securities from over 130 countries and their value reaches USD 64 billion; global DTCC repository processes around 280 million messages a week, while maintaining nearly 40 million OTC (over-the-counter) positions)18. The potential of dematerialization proves the extent of activity of entities such as DTCC, which deals with storing dematerialized data and provides financial services after the transaction (so-called post-trade financial services).

The analysed obligatory dematerialisation of securities in the non-public sector may contribute to increasing the attractiveness of the Polish investment market. It is a legislative attempt to adjust the internal legal order to the current technological needs of the modern foreign investment market in non-public securities. There is at present an attempt at a further amendment that would introduce the obligation to dematerialize shares of private companies which would be a revolution on the Polish capital market.

13.

Simple joint-stock company de lege ferenda – planned entry into force: March 2020 ^

The concept of a Simple Joint Stock Company («simple JSC») proposed in the draft Act on the amendment to the Code of Commercial Companies raises numerous controversies among the representatives of the doctrine19,20. The opponents of the amendment suggest that there is no need to create an additional legal form of a company21. The opinion22 has been expressed that the most appropriate type of legal form (type of company) in which start-ups can function is the form of the current limited partnership (article 102 et seq. of the Polish Commercial Companies Code). As a counterargument to the creation of the simple JSC, a considerable flexibility in the construction of the current solutions (available in the limited partnership) is indicated as compared to the simple JSC (the possibility of registering the company using an electronic form, limited liability of some partners, tax benefits regarding personal income tax). In addition, the possibilities of creating a hybrid ownership structure are emphasised, in which a limited liability company is a partner of a limited partnership23. Some opinions are also expressed that the method of legislation regarding the simple JSC is far from perfect, especially that the amended provisions refer to the already existing ones, which regulate the existing forms of companies, thus creating cascade provisions (referring to the principles of creating and managing a limited liability company or a joint-stock company). For example, the proposed article 30013 § 1 of the Commercial Companies Code (regulating a simple JSC), requires to apply to a simple JSC mutatis mutandis the provisions of the limited liability company (provisions of article 164 § 3, article 165, article 169, article 170 and article 172, respectively of the Code of Commercial Companies).

According to the justification24 to the draft act on the amendment to the Code of Commercial Companies, it follows that a simple JSC is to be a modern form of a private equity company intended for innovative ventures. For a simple JSC, unlike for other types of commercial companies, the possibility of new categories of contributions has been created to cover the shares, namely the shares will also be covered by the services of work of the shareholders, know-how, knowledge, etc. Therefore, it will be of considerable importance for start-ups, where in kind (non-monetary) contributions are very popular. On the other hand, a simple JSC is characterized by a modern mechanism of protection of the company’s creditors. It is proposed to depart from the share capital structure existing in limited liability companies in favour of flexible restrictions on payments to shareholders. The restrictions are to take into account both the extent of the company’s aggregate debt and the degree of the company’s solvency. A considerable flexibility of the operation of the simple JSC is also reflected in the formation of privileged shares, which would allow the founders of a simple JSC to raise capital through subsequent issues of shares without the risk of losing control over the company.

14.

The definition of «start-ups» in the Polish commercial law ^

The construction of a simple JSC, regulated in the analysed amendment from article 3001 of the Code of Commercial Companies, through the introduction of the new Section IA of Title III of the Code of Commercial Companies to the current Code of Commercial Companies and Partnerships (articles 3001–300133), is to meet the current needs of start-ups. In the Polish legal order, the term start-up is non-statutory. Since there is no statutory definition of a start-up, professional literature might be of help. There are several definitions of start-ups functioning in the Polish doctrine of commercial law. From the perspective of legal work, a start-up should be understood as an enterprise (business activity) at an early stage of development, most often conducted in the field of so-called new technologies25.

There are other definitions of start-ups, also created by economists. The definitions included in the 2016 Deloitte report26, referred to in the course of the legislation process, also seem to be adequate in relation to the proposed assumptions of a simple JSC. This report refers to the definition of Steve Blank according to which a start-up is an organization created to search for a repeatable and scalable business model. A reference is also made to the definition of a start-up coined by Eric Ries, according to which a start-up is a venture pursued to create new products and services in conditions of extreme uncertainty. In the justification to the analysed amendment, start-ups are projects that have the potential of very fast growth due to technological superiority or a market niche that has not yet been discovered and managed. These projects are most often implemented in the area of new technologies, in conditions of high market uncertainty, at the stage of seeking a repeatable and scalable business model.

15.

Ratio legis of a simple JSC for start-ups in Poland ^

The start-ups market in Poland is considerably increasing. It is estimated that, assuming favourable legal conditions for start-ups, this market will generate more than PLN 2.2 billion of added value and up to 50,000 additional jobs, which will in turn translate into household income27. The latest report of the Startup Poland Foundation28 shows that a simple JSC is a desirable form among entrepreneurs. Currently, the limited liability company is invariably in the first place among the preferred legal forms of conducting business by start-ups (in 2016 it was 68% and in 2017 it was 71%). The report also shows that there is a lot of interest in a simple JSC among start-up companies. In the survey performed, every third person is interested in re-registering the current business activity to a simple JSC.

Despite the fact that among start-ups the most widespread legal form is that of a limited liability company, this legal form does not fully meet the requirements of entrepreneurs operating in this segment. This is due to the fact that the structural element of the limited liability company is the share capital. The problem is also: a) the lack of the possibility of creating non-voting shares; b) the requirement of notary participation in the disposal of shares (in Poland it is currently connected with the conclusion of a written contract with signatures certified by a notary); c) the minimum value of the nominal share of PLN 50. What is of significance in the limited liability company is the financial contribution and on this basis the position is assessed in the company. At the same time, the personal qualities of the shareholder, work or services contribution are of no significance. The simple JSC aims to change this.

On the other hand, a regular joint-stock company is more expensive and more complicated in its operation and management as compared to the limited liability company. The resolutions adopted by the general meeting of shareholders must be recorded by a notary public and annual reports must be audited by a statutory auditor. This alone entails extensive costs for the start-up, not to mention that the minimum share capital in a regular joint-stock company is PLN 100,000. The new type of company (a simple joint-stock company), as predicted by its promoters, will be able to be used not only to run business based on new technologies and should not be limited only to the start-ups segment.

The model of a simple JSC in Poland includes solutions applied for simplified joint-stock companies in other jurisdictions. In France, there operates the so-called simplified joint-stock company (Société par Actions Simplifiée – SAS), whose share capital amounts to EUR 1; in Slovakia, as of 1 January 2017, this is (Jednoduchá Spoločnosť na Akcie) where the minimum share capital is also EUR 1; similar solutions are applied in the Czech Republic, Finland, the Netherlands, Germany and Luxembourg.

16.

New legal concept of «monetary and non-monetary share capital» (article 3003 § 1 of the Code of Commercial Companies) ^

In a simple JSC there will be no institution of a standard «share capital». Instead of the standard share capital, monetary and non-monetary share capital will be introduced. The share capital in a simple joint-stock company will have a flexible character, since its amount will not be indicated in the company’s shareholders agreement, and its change will not take place in a formalized way but it will be each time determined by the management board of the company. Such a share capital model refers to the American concept, in which in order to run the company no share capital is needed.

17.

Setting up a simple JSC online without the presence of a notary public ^

As in the case of the limited liability company, it will also be possible to establish a simple joint-stock company through an online agreement template. It will be connected with the necessity to fill in a form that will be made available in the ICT system, with the use of an electronic signature. The advantage of registering the company using an ICT system is that the registration is less complicated. Shareholders' agreement can be signed without the presence of the notary public, yet it should be kept in mind that in such case, the contributions to the company may only be monetary. Such a solution may limit the functioning of a simple JSC, but as the legislators indicate, there are at present no appropriate IT systems that would enable making non-cash contributions online.

18.

Dematerialisation of the shares of a simple JSC ^

A simple JSC introduces the obligation to dematerialize the shares issued by this company. It is therefore expected that simple JSC shares will be registered in the shareholders' register. In the case of taking up of shares, the entry into the shareholders' register follows the entry of the company into the register or after the entry into the register of a new share issue. Additionally, it is expected that the shareholders' e-mail addresses will be entered in the register, so that the communication between them and, for example, other shareholders or investors would be faster and cheaper. Pursuant to the proposed Article 30030 § 3 of the Code of Commercial Companies, the shareholders' register is kept in an electronic form. The Polish Code of Commercial Companies does not contain the definition of «an electronic form», therefore, a broad understanding of this term is assumed. According to the proposed Article 30030 § 3 of the CCC, the shareholders' register will be able to take the form of a dispersed and decentralized database. It will therefore be possible to keep the register in blockchain technology. The operation of shares in the blockchain29 system would lead to a significant change in the dynamics of the company’s shareholding as compared to the paper form. This means that transferring the ownership to such a share would be much easier and probably more often used. Each applied technology implementing the share register in order to be consistent with the proposed Article 30030 § 4 of the Code of Commercial Companies, regardless of the form, must ensure that the register is kept in a manner that ensures the security and integrity of the data contained therein.

19.

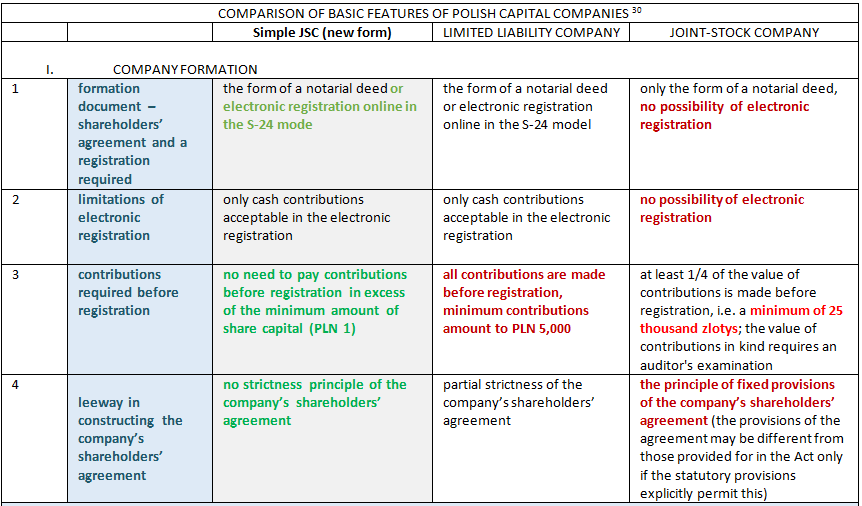

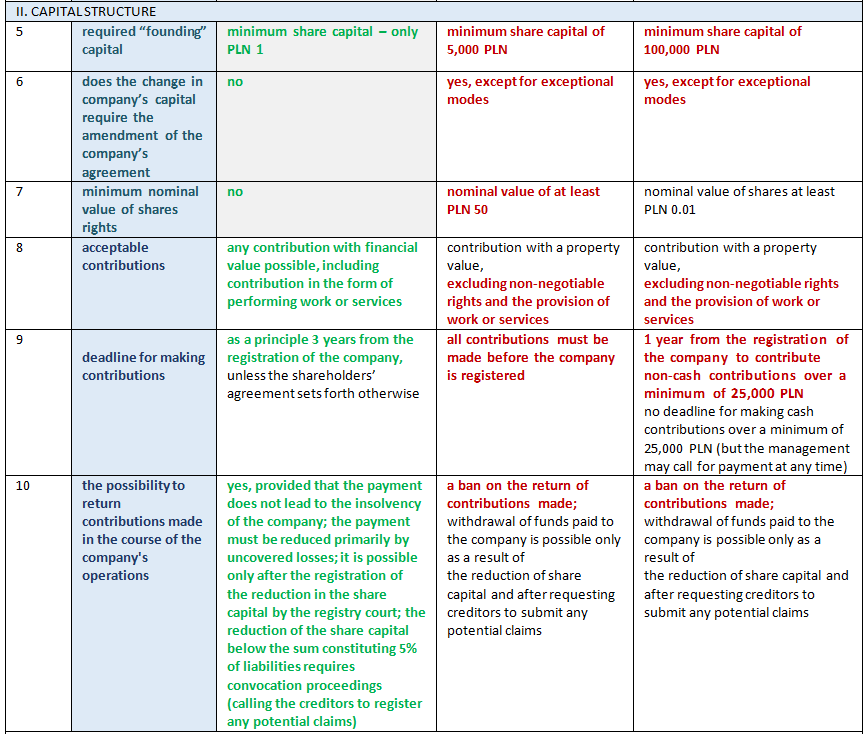

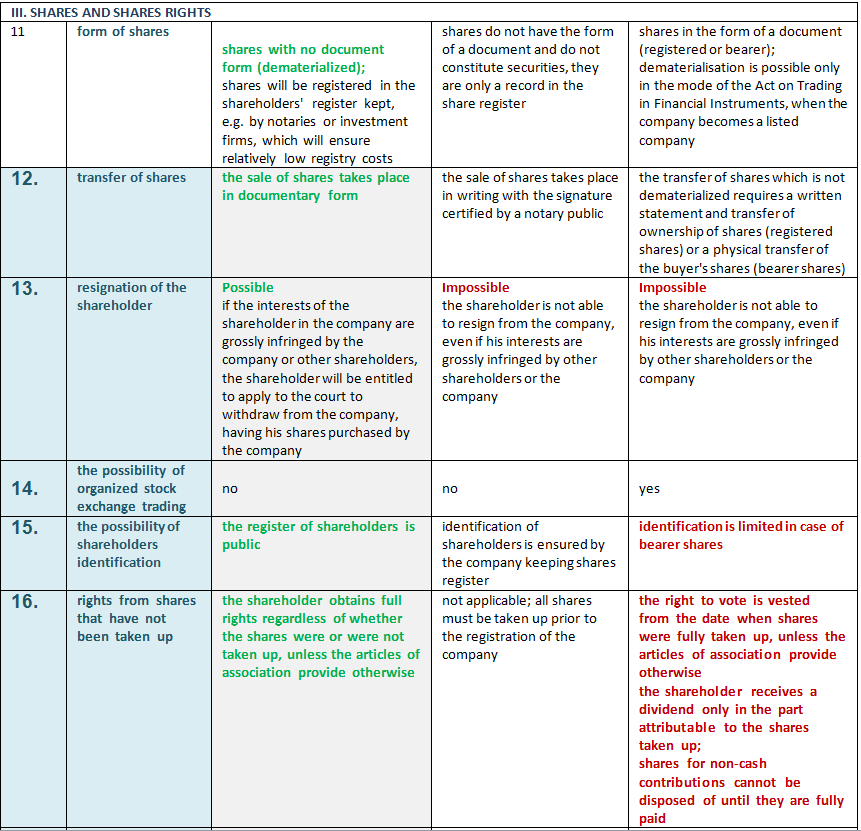

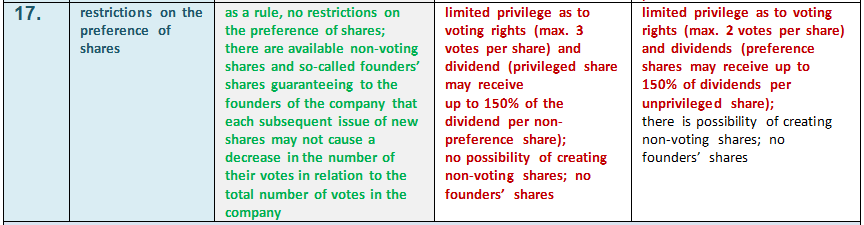

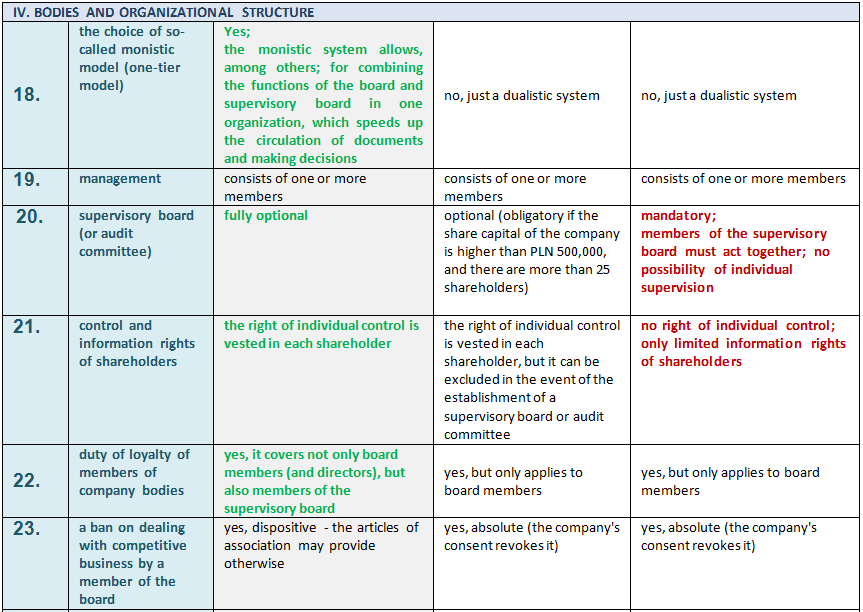

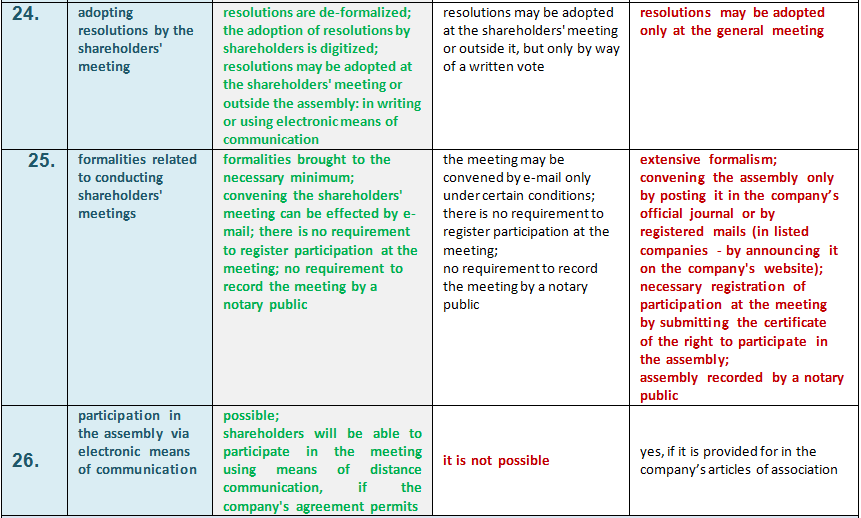

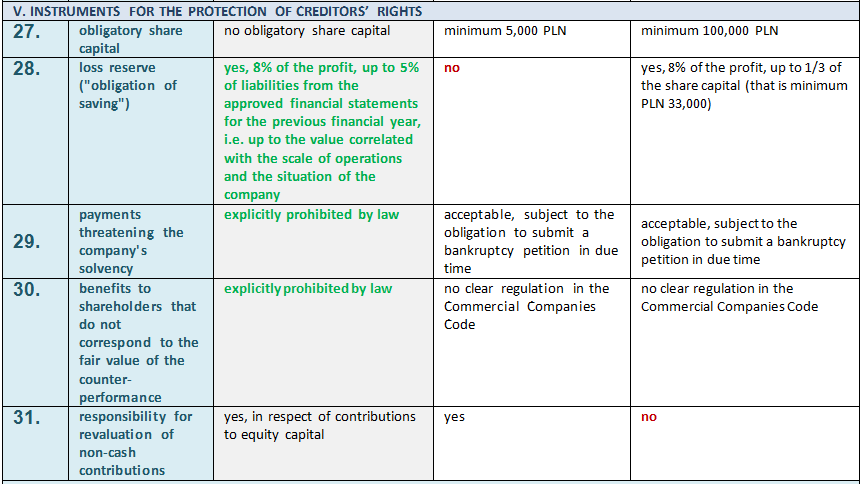

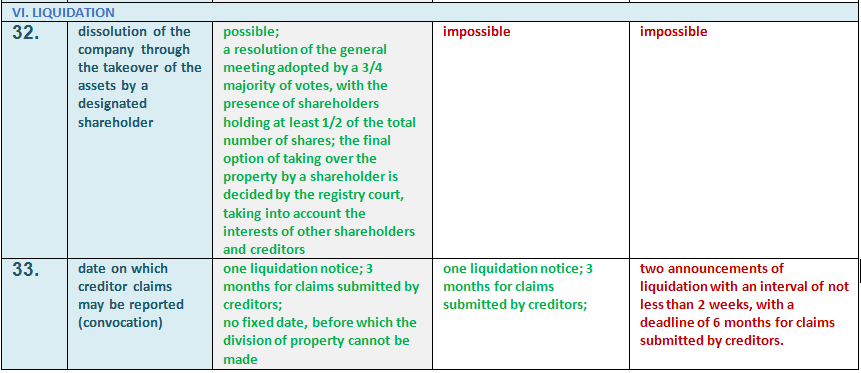

Conclusion – summary of the key characteristics of the planned simple JSC from the perspective of the investors in new tech start-ups ^

The above analysis of a simple JSC concerns the draft law proposed by the Polish legislator, according to which the entry into force of a simple JSC is planned for March 2020. The parliamentary procedure is advanced; hence as a summary it is justified to present general features of a simple JSC in comparison to the structures of the companies currently operating in the Polish market, namely a limited liability company and a joint-stock company.

Jakub Gładkowski, Attorney, Founding Partner of KG LEGAL Kiełtyka Gładkowski, based in Poland, specialising in IT, new technologies, media & telecommunication law, especially in investment processes, foreign investments in Poland and IP Law. Ranked in the Legal 500 rankings, Legal 500 EMEA 2019, as the leading law firm in Poland. He is a Mediator at the Business Mediation Center of the National Chamber of Legal Counsels in Warsaw and Private Investigator. He has completed legal studies and postgraduate studies at Freie Universität in Berlin (LL.M.).

Aleksander Kulasza, Associate at KG LEGAL Kiełtyka Gładkowski, student of legal studies at the Faculty of Law and Administration at the Jagiellonian University in Krakow. The area of his professional interests includes: civil law, commercial law, including commercial company law, private banking law and international commercial law.

- 1 The Act on Bonds of January 15, 2015 (Journal of Laws of 2018, item 2243, as amended, hereinafter: «The Act on Bonds»).

- 2 Act of September 15, 2000 Code of Commercial Companies (Journal of Laws of 2000, number 94, item 1037, as amended, hereinafter: «Commercial Companies Code»).

- 3 Act of 9 November 2018 on amending certain acts in connection with the strengthening of supervision over the financial market (Journal of Laws of 2018, item 2243, as amended), hereinafter: «Amending Act in connection with the strengthening of supervision over the financial market»; in accordance with the content of the inter-temporal provision in the form of article 48 point 3 of the Amending Act in connection with the strengthening of supervision over the financial market.

- 4 Government bill amending the act – Code of Commercial Companies and certain other acts; full electronic version of Sejm Paper No. 3236 along with the course of legislative work before the draft is submitted to the Sejm in the Government Legislation Center, available on the Sejm website: https://sejm.gov.pl/sejm8.nsf/PrzebiegProc.xsp?nr=3236 (all websites last visited on 16 May 2019), hereinafter: «Draft Act amending the Code of Commercial Companies»; in accordance with the content of the inter-temporal provision in the form of article 36 of the draft Act on the amendment to the Code of Commercial Companies.

- 5 Act of July 29, 2005 on Trading in Financial Instruments (Journal of Laws 2005 number 183, item 1538, as amended, hereinafter: «Act on Trading in Financial Instruments»).

- 6 Publication as part of the distribution of the Polish Press Agency in the GazetaPrawna.pl portal, of 14 March 2019 «Work has begun on Prosta Spółka Akcyjna. Yesterday in the Sejm the first reading of the bill took place»: source (press release): https://prawo.gazetaprawna.pl/artykuly/1403051,ruszyly-prace-nad-prosta-spolka-akcyjna.html.

- 7 L. Sobolewski in: The law of securities. Private Law System. Vol. 19, ed.: Szumański/Sobolewski, page 1043 and following.

- 8 Regulation (EU) No 909/2014 of the European Parliament and of the Council of 23 July 2014 on improving securities settlement in the European Union and on central securities depositories, amending Directives 98/26/EC and 2014/65/EU, and Regulation (EU) No. 236/2012.

- 9 Justification of the Amending Act in connection with the strengthening of supervision over the financial market; full electronic version of the Sejm print no. 2812 with justification and the course of work before the bill was submitted to the Sejm in the Government Legislation Center, available on the Sejm website http://sejm.gov.pl/Sejm8.nsf/PrzebiegProc.xsp?nr=2812 – page 6 and the following.

- 10 Within the meaning of the Act of 29 September 1994 on accounting (Journal of Laws of 1994, number 121, item 591).

- 11 M. Gault, Paper’s «Dematerialization» Will Disrupt All Industries, https://www.wired.com/insights/2013/02/papers-dematerialization-will-disrupt-all-industries/.

- 12 Source of graphic number 1: http://students.mimuw.edu.pl/SO/Projekt02-03/temat4-g8/potakiewicz/secure.html; in: D. Potakiewicz, Technologies ensuring security in operating systems.

- 13 Guardtime Federal, LLC Proprietary, Keyless Signature Infrastructure® (KSI™) Technology, http://blockchain.machetemag.com/wp-content/uploads/2017/11/Guardtime_WhitePaper_KSI.pdf.

- 14 Source of graphics: https://guardtime.com/technology.

- 15 The source of the material under the Youtube licence: «Procedure of dematerialisation of securities, commerce educators»: https://www.youtube.com/watch?v=AKXrZW3fECQ.

- 16 Government Securities Dematerialization, The Government Securities Demarterialization Act, https://moj.gov.jm/sites/default/files/laws/Government%20Securities%20Dematerialization%20Act.pdf.

- 17 General information available at the address: https://en.wikipedia.org/wiki/Depository_Trust_%26_Clearing_Corporation.

- 18 New DTCC Data Products Service To Provide Dynamic Data Provisioning and Easier Access to DTCC Data, http://www.dtcc.com/news/2015/june/30/new-dtcc-data-products-service-to-provide-dynamic-data.

- 19 P. Dzierżak, Prosta Spółka Akcyjna - multiplication of entities over the need or appropriate remedy for problems of entrepreneurs?, Monitor Prawa Handlowego, 2016 No. 2, pp. 38–43.

- 20 M. Romanowski, Einstein's and Father Twardowski’s Method as a way of analyzing the concept of a Simple Joint Stock Company, Monitor Prawa Handlowego, 2016 No. 2, pp. 45–46.

- 21 M. Romanowski, Difficult Joint Stock Company, namely what Thomas Aquinas and rock band TSA would think about the simple Joint Stock Company, Monitor Prawa Handlowego, 2017 No. 4, pp. 43–48.

- 22 W. Górecki, A. Kappes (in:) System Prawa Handlowego, Volume 2A, A. Szumański (ed.), Warsaw 2018 pp. 539–540.

- 23 Ibidem.

- 24 Governmental Act on the Amendment of the Polish Commercial Companies Code.

- 25 W. Górecki, A. Kappes (in:) System Prawa Handlowego vol 2A, A. Szumański (ed.), Warsaw 2018 p. 539.

- 26 Diagnosis of the startups ecosystem in Poland, June 2016, joint publication https://www2.deloitte.com/content/dam/Deloitte/pl/Documents/Reports/pl_Deloitte_raport_startupy.pdf.

- 27 Ibidem.

- 28 M. Beauchamp, J. Krysztofiak-Szopa, T. Ociepka, A. Skala, Report on Polish Start-ups 2018, https://www.startup.pfr.pl/media/filer_public/0f/c9/0fc9c629-3825-4208-86bc-aa1e982784fa/raport_startup_poland_2018.pdf.

- 29 Blockchain and Simple Joint Stock Company, 12 February 2019, publication of a website: https://prosta-spolka.pl/podstawowe-fakty/blockchain-i-prosta-spolka-akcyjna/.

- 30 Graphic source: the table follows as an attachment the justification of the Governmental Act on the Amendment of the Polish Commercial Companies Code.