1.1.

The Growing Need for Sustainability Information Caused by a Legislative Tsunami ^

The European Green Deal sets ambitious sustainability targets for the European Union and its citizens [European Commission COM(2019) 640 final]. The EU aims to mitigate and adapt to climate change by rebuilding natural capital and strengthening resilience and wider social capital [European Commission COM(2021) 390 final, 5]. The European Climate Law (EU) 2021/1119 makes the goals of the Green Deal legally binding. EU Member States have legal obligations to aim at climate-neutrality. The proposed Nature Restoration Law aims to restore ecosystems, habitats and species in land and sea areas and to achieve EU’s climate and biodiversity goals [European Commission COM(2022) 304 final]. Placing sustainable finance at the centre of the financial system is crucial in order to accomplish a green transition of the economy. To achieve this goal, sustainability-related information must be accessible to investors when making investment decisions [European Commission COM(2021) 723 final, Recital (2)].

The acronym “ESG” (Environmental, Social and Governance) can be seen as the main content of sustainability. It reflects the fact that sustainability is not just about climate. Investors and other market participants are increasingly demanding ESG information. However, these demands are not met. Instead, there is a lack of easily accessible and digitally usable ESG information. The absence of common standards is one of the main barriers hindering the use of ESG-related data. Standardization would enhance the comparability, reliability and reusability of information [European Commission SWD(2021) 344 final, 18, 90–91].

The need for sustainability-related information is also highlighted in the recent legislative actions by the European Union. The EU Taxonomy Regulation (EU) 2020/852 is aimed at building a common definition of sustainability and thereby preventing greenwashing, where products can be marketed as environmentally friendly when they are not. In order to enhance sustainable investing, new mandatory disclosure regimes are built and a set of investment tools are introduced. These tools include benchmarks, standards and labels, such as a standard for European green bonds and EU Ecolabel for financial products [European Commission COM(2021) 390 final, 2–4]. In addition to general-level sustainability regulation, the EU has recently proposed more specific legislation, for example on deforestation-free products. The loss of forest areas is a problem especially with palm oil, soya and cocoa [European Commission COM(2021) 706 final].

A proposed Regulation establishing a European Single Access Point (ESAP) [European Commission, COM(2021) 723 final] seeks to contribute to achieving sustainability targets by making sustainability information more easily accessible and usable. The ESAP is meant to be a centralized platform that gives easy digital access to publicly available information of relevance to financial services, capital markets and sustainability about companies and their products. In order to make information digitally usable, information should be “in a data extractable format or, where required by Union law, in a machine-readable format”. The latter format enables software applications to identify, recognize and extract data easily. In addition to obligatory disclosures, voluntary information can be made accessible on ESAP as well. The aim of the ESAP is to bring simplification and improved efficiency by streamlining disclosure channels, without bringing new disclosure requirements. The ESAP should include, among other functionalities, a search function, machine translation and possibilities to extract the information. It will also enable the offering of innovative services that are based on analytics, big data and AI [European Commission COM(2021) 723 final].

The wealth – sometimes called a tsunami – of recent legislative actions illustrates the growing need for sustainability information. However, these actions do not cover all decision-making situations and business contexts. Furthermore, greater information flows are not enough – the content, format and design of information determine its usability and value. The EU has paid growing attention to the machine-readability of information. For instance, the Digital finance strategy of the EU sets machine-readability as an important target and states that by 2024, information that is publicly released under EU financial services legislation should be disclosed both in “standardised and machine-readable formats” [European Commission COM(2020) 591 final, 12].

1.2.

The Aim of Our Paper: Taming the Tsunami ^

Although EU’s mandatory sustainability reporting requirements are targeted mainly at larger companies, retail investors and consumers as well as small and medium-sized enterprises (SMEs) are critical for the sustainability transition. Sustainability projects can be small and local – yet necessary for the green transition [European Commission COM(2021) 390 final, 7]. For this to succeed, easily accessible and readable sustainability information is needed.

We argue that accessibility and readability alone are not enough. Information should also be actionable. In order to be effective, it should help lead to actions that promote sustainability. That is why we use the terms human-actionable and machine-actionable information in this paper. In addition, we take into account the need to combine the two and call for sustainability information that is actionable for both humans and machines.

The following chapters discuss important practical contexts where sustainability information is at the core. Apart from choices made by consumers, the sustainable transition is actually realized at the firm level, investor level, and supply chain level. Commercial contracts made at these levels offer themselves as tools with which sustainability can be advanced.

Legal Design and AI tools can significantly help in taming the legislative tsunami and overcoming the difficulties in accessing and using sustainability information. We introduce some of the most prominent tools and provide practical examples of their use. Easy access to reliable sustainability information can have a major impact on sustainable investment decisions. Sustainability requirements can also be built into commercial contracts. Our paper deals with information that monitors or reports on sustainability and information that promotes or requires sustainability. With the tools that we put forward, important information can be presented more easily and actionably, found and extracted from data masses more easily and thus, serve as a strong foundation for sustainable actions – for both humans and machines.

2.1.

Company Reporting as a Source of Sustainability Information ^

Sustainability is executed via concrete business and investment decisions and everyday actions. In supply chains, it can be driven by contracts implementing those decisions. At the firm level, sustainability reporting requirements set on companies force them to take into account ESG-related matters. Although sustainability reporting has a long history [Kolk 2004], it has been mostly implemented by the largest companies, and due to lack of regulation, the format has varied. The new EU Corporate Sustainability Reporting Directive (CSRD) proposal [European Commission COM(2021) 189 final] extends the Non-Financial Reporting Directive 2014/95/EU (NFRD) and brings along new, considerably wider mandatory sustainability reporting standards. The CSRD rules will apply to all large companies and all listed companies, including listed SMEs. Only listed micro-companies are excluded from the scope of the proposal. Insurance undertakings and credit institutions will also fall under the Directive, regardless of their legal form. Some of the standards will be for all companies, while others are targeted at specific sectors. This approach takes into account the high sustainability risks in certain sectors. To ensure the proportionality of the legislation, SMEs will have their own standards. “Sustainability matters” that must be reported concern environmental, social and human rights and governance factors. The CSRD will be mainly applied from the beginning of 2024, with the longest transition period for listed SMEs. Delegated acts will further specify the content of the new reporting requirements.

The CSRD seeks to ensure that sustainability information is comparable and that all relevant information is disclosed. Common standards enable auditing and digitalizing sustainability reporting. The Directive also aims at machine-readability of information: reports should be made in XHTML format. This is based on the requirement to use the European Single Electronic Format in annual financial reports. XHTML is human readable, and XBRL “tags” can be embedded into the document. So the CSRD aims at combining human- and machine-readability [ESMA n.d.]. Sustainability information should be marked up in the same way: companies must digitally tag the reported information in order to enhance machine-readability. This type of information can be easily accessed from the ESAP, which needs structured data. The CSRD creates “the foundation of a consistent flow of sustainability information” for all stakeholders of companies [European Commission COM(2021) 188 final, 8].

The CSRD proposal is a major improvement over previous practices, as sustainability reporting (and company reporting overall) has been plagued by a complex structure where actionable information has been difficult to find. Company reports are long but lack useful content, consisting of boilerplate and long sections of legal jargon [Dyer et al. 2017]. This is somewhat surprising as, for example, in the United States, authorities have worked on simplifying the language of company reporting for decades. The current setting has created a situation where numerous regulations force companies to disclose detailed information about their operations, but relevant stakeholders, like analysts and investors, are not using that information in their decision-making [Loughran/McDonald 2017]. Furthermore, the situation has created a growing market for third-party information about company sustainability actions from the reporting and concrete actions perspective.

Companies themselves would benefit from high-quality sustainability reporting as well. Company reporting needs to be simplified to initiate the interest of stakeholders in using the reports in their practices. Sustainability reporting especially needs harmonised, regulated, high-quality reporting standards that help make the information human- and machine-readable and actionable. The discussed sustainability actions are often unspecific, opening the door to questionable practices, like greenwashing. However, as the amount of money invested sustainably is calculated in tens of trillions of Euros [The Net Zero Asset Managers initiative n.d.], the information behind the investment decisions needs to be of highest quality. As a growing number of investment products pursue sustainability objectives, good sustainability reporting can help them access financial capital. In addition, such reporting can help companies manage their own sustainability risks and opportunities [Council of the European Union 2022].

2.2.

Sustainability Information Furthering Sustainable Investing ^

In order to achieve the goals set in the Green Deal, capital flows should be channelled towards sustainable investments. According to the Taxonomy Regulation, they should become mainstream options, and the sustainability impact of financial products and services needs to be widely considered. Effective and harmonized disclosures are at the core when investors are encouraged to invest in sustainable products. The Sustainable Finance Disclosure Regulation (SFDR) (EU) 2019/2088 obliges financial market participants and financial advisors to disclose specific sustainability information to end investors. In the advice situation, the advisor can significantly guide the decision-making process. Therefore, integrating sustainability matters into the advising process is essential. New duties concerning the identification of clients’ sustainability preferences are likely to make sustainability more apparent in the advising process and increase the demand for sustainable investment products [European Commission COM(2021) 188 final, 11].

One important objective of the new EU legislations is to help investors identify sustainable investments. Therefore, the term “sustainable investment” is harmonised in the SFDR. According to its Article 2, sustainable investments can contribute to environmental objectives as measured, for instance, by key resource efficiency indicators on the use of energy and the production of waste and greenhouse gas emissions. Sustainable investments can also advance social objectives, such as tackling inequality. In order to enhance the identification and comparison of sustainability disclosures, the European Commission has formulated standardized disclosure templates in its Delegated Regulation (EU) 2022/1288, which specifies the SFDR. These templates refer in their definitions to the EU Taxonomy Regulation that creates more exact criteria for environmentally sustainable investments and lists the activities and objectives that can be labelled environmentally sustainable. Common criteria will help combat greenwashing. The Benchmarks Regulation (EU) 2016/1011 and its later amendments also provide tools for investors to identify sustainable investments.

The Platform on Sustainable Finance – established by the European Commission – is an advisory board that helps to further develop sustainable finance and the EU Taxonomy. Globally, one of the most recent developments on sustainable finance is the new ISO Standard of Sustainable Finance. It aims to provide guidance on how key sustainability principles can be integrated into the operations and business strategies of organizations. With the help of the new ISO Standard, companies can demonstrate their compliance with the sustainability principles and practices [ISO 32210:2022(en)].

2.3.

Fostering Sustainability with Contracts ^

According to the CSRD proposal, reported sustainability information should take into account not only the reporting organization’s own operations, products and services, but also its business relationships and supply chain – in fact, its whole value chain within and outside the EU [European Commission COM(2021) 189 final, Recital (29)]. Supply chains are a focus area also in the proposal for a Directive on Corporate Sustainability Due Diligence (CSDDD) adopted by the EU Commission in February 2022 [European Commission COM(2022) 71 final]. Recognizing the key role companies play in building a sustainable economy and society, the proposal requires companies to identify and, where necessary, prevent, end or mitigate adverse impacts of their activities on human rights and on the environment. In order to comply with the corporate due diligence duty, companies need to, among other things, integrate due diligence into policies; establish and maintain a complaints procedure; monitor the effectiveness of the due diligence policy and measures; and publicly communicate on due diligence.

The CSDDD proposal draws attention to the critical role contracts and procurement practices play in fostering sustainable and responsible corporate behaviour throughout global value chains. While SMEs are not directly in the scope of this proposal, many of them, too, will be involved through contractual cascading, where companies pass on sustainability requirements and obligations in their value chain. Proposed EU legislation is putting pressure on companies to upgrade their commercial contracts and procurement practices to explicitly address ESG matters and to include responsible purchasing practices in their contracts. EU Commission is expected to issue guidelines and non-binding model contractual clauses on how companies should fulfil their due diligence obligations in their value chain. These developments will bring contracts and their actionability to the fore.

3.

Legal Design and AI Tools Helping to Make Information Actionable ^

Recent EU legislative actions are meant to enable the transition towards sustainability goals. They seek to engage companies and their value chains in good corporate behaviour and sustainable contracting. They also seek to increase transparency and provide investors and other users tools with which sustainable investments and companies can be discovered and chosen [European Commission COM(2021) 188 final, 12]. The intentions are certainly good, but the legislative tsunami – not only in the EU, but also globally – and the resulting requirements and loads of information can become overwhelming for those who are impacted.

There is also a paper tsunami in the context of procurement contracting in value chains. Supplier onboarding processes and buyer requests for proposals, purchase orders, terms and conditions, and contracts have become so complex that readers give up. SMEs cannot spend hours or days working out what is required of them to comply with different buyers‘ contracts and Supplier Codes of Conduct – they do not have the resources, so they’d rather walk away and seek other opportunities.

While current contracts and Codes of Conduct may work well for one-sided safeguarding and risk allocation purposes, they are out of synch with their business purpose, the new tech-enabled world of commerce, and the new paradigms of discourse enabled and promoted by digitization [Haapio 2020, IACCM 2017]. Legal Design seeks to change this, put users in the centre, and humanize every aspect: make contracts, Codes of Conduct and sustainability information fit for purpose so they communicate in an engaging and actionable way to both business and legal audiences. The EU has recently noted in its retail investor study that the current disclosure framework is not enough, as the templates are not engaging. Engagement is a necessary precondition for understanding and acting upon information. [European Commission et al. 2022, 14]. Experience and research tell us that this applies to all kinds of communications: to be actionable for humans, they should be engaging.

As regards content and how it is presented, how can we make sense of legalese or sustainabilitese: jargon that is meaningful only for a small group of experts? We argue that AI tools can help. AI has the potential to disrupt the way information is generated, presented, analyzed, read and translated into action. It has in fact already done so. A good example of AI developments offering great promise for this space is GPT-3, Open AI’s Generative Pre-trained Transformer 3 [Brown et al. 2020]. Next we will demonstrate how GPT-3 can help both readers and writers of sustainability-related information.

4.

AI Tools at Work – Example Cases ^

The deep learning revolution in the 2010s started with computer vision, but found its way relatively quickly to textual analysis [LeCun et al. 2015]. Textual tools before the deep learning methods most often relied on word frequencies. A good example is Latent Dirichlet Allocation, which aims to identify latent topics in a collection of documents [Blei et al. 2003]. This approach represents documents as bags of words, meaning that only word frequency information is saved from each document. Naturally, this approach has limitations, as much information from the documents is lost during the process. The first step in improving this approach was the implementation of different word embedding models, where neural networks are used to map dictionary words to word vectors that also save semantic information about words [Mikolov et al. 2013]. Words that are used on similar occasions are close to each other in these vector spaces. The ideas of word embeddings were further developed with the transformer architecture used by most of the recent state-of-the-art Natural Language Processing (NLP) models [Devlin et al. 2019]. This methodological innovation is behind the many new possibilities that popular new NLP models, such as BERT [Devlin et al. 2019] and GPT-3 [Brown et al. 2020], are opening for practice.

Furthermore, academia has started to realize the potential of these tools for research [Ranta et al. 2022]. Although BERT and GPT-3 both use the transformer architecture, they have fundamental differences in that BERT uses only the encoding part of the architecture, and GPT-3 uses only the decoding part of the architecture. This difference makes them suitable for different tasks. BERT is trained to guess both a masked word from a sentence and a next sentence, making it efficient for tasks like sentiment analysis. GPT-3 is trained to predict the next word for a given context. This makes it excellent for text-generation tasks like abstract summarization and question answering. Therefore, we proceed by demonstrating the possibilities of language models for analyzing and creating sustainability information with GPT-3 [OpenAI n.d.]. While there are already several ML-based language models with similar capabilities, we consider GPT-3 to be an excellent choice for our demonstration due to its architecture and because it is free, easily accessible and proven to be powerful in practical applications.

In the first example (Figure 1), we demonstrate how GPT-3 can be used to extract meaningful information from company disclosure. In the example, we have a section of text from the MD&A (Management discussion and analysis) part of an annual report. Using GPT-3, we extract actions related to ESG from the text (lower part of the figure). As we can see, GPT-3 can identify key actions that the company has done in the area of ESG from the text. This demonstration is an example of abstractive summarization. ML-based text summarization can be divided into two approaches: extractive and abstractive. More traditional algorithms have used extractive summarization, which means identifying the key sentences from a text. The more challenging task of abstractive summarization aims to identify the key content from the original text and create new text to summarize the content of the original. As we can see from the example, with the advent of state-of-the-art NLP models, such as GPT-3, abstractive summarization of NLP models starts to be at the level for it to have practical relevance. GPT-3 is able to identify – in a matter of seconds – key ESG actions from the text and describe them comprehensively using correct English.

Figure 1: Extracting ESG Actions from Company Annual Report with GPT-3

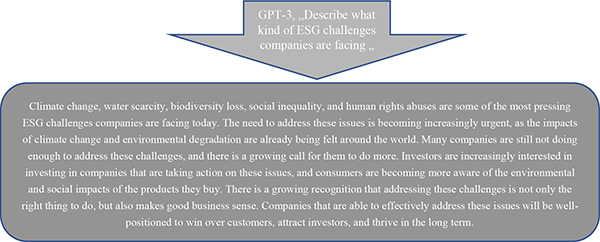

Our second example demonstrates the text generation capabilities of GPT-3. Figure 2 shows an output GPT-3 creates when we prompt it to create text discussing challenges companies are facing related to ESG. As we can see from the output, GPT-3 is able to highlight and describe comprehensively key issues companies are facing when moving their business towards sustainable practices. The text generation capabilities of models such as GPT-3 open up the possibility to use them for practical applications, for example for creating first draft sustainability guidelines for companies. In many ways, these new NLP models are not doing something that is completely new. For example, text summarization and creation are not new things for ML-based textual methods. The new models using transformers architecture just do these much more comprehensively and reliably. This improvement is mainly because these models are much larger than previously, trained with huge amounts of text. For example, GPT-3 is trained using 400 billion tokens (words). These large corpora allow NLP models to thoroughly learn the “discussion” of many different topics, like sustainability, and aid practitioners and researchers in these topics in many versatile ways.

Figure 2: Describing ESG Challenges with GPT-3

Despite of their many capabilities, AI tools can sometimes include biases and errors. The performance of GPT-3 is thoroughly tested with different artificial benchmark datasets, where it has achieved state-of-the-art results with an accuracy of over 90%, for example, in complicated text completion tasks [Brown et al. 2020]. However, quantitative research on the reliability of large language models in practical settings is in its infancy. A few papers have tried to estimate their validity from different perspectives. For example, Gehman et al. (2020) have studied how GPT-3 and other similar language models can create toxic language, as their training data covers all kinds of data from the Internet, also toxic language from discussion forums [Gehman et al. 2020]. OpenAI has already developed its GPT models by creating InstructGPT that can be finetuned to avoid undesired results [OpenAI 2022] and ChatGPT that is trained to specialize in dialogue and be more reliable. Despite this, the draft reports, explanations and summaries generated by AI require human oversight.

While web translators Google Translate (https://translate.google.com) and DeepL Translator (https://www.deepl.com/translator) translate between languages, GPT-3 and ChatGPT can translate legalese into plain language (and vice versa). AI-powered translation of legalese into ordinary language can help for example the creators of guidance documents and layered contracts [Waller et al. 2022, Waller 2022]. Text-in, text-out is no longer the only application. Open AI’s DALL-E [OpenAI 2021(a)], built on top of GPT-3, can generate images from text. DALL-E2 generates photo renderings and illustrations. We expect it to be soon able to generate timelines, flowcharts and other diagrams, too. These and other visual design patterns could be used as explanations in various documents, including contracts [Haapio/Passera 2021].

One of the authors of this paper has already examined merging GPT-3 generated summaries and explanations with contract layering, displaying different layers for different reader needs: an action layer for quick skim reading; an explanation layer for a deeper understanding, containing clear text written from the user’s perspective; and the full text. [Corrales Compagnucci et al. 2022]. The next version could also include a code layer for machine-actionability. Creative Commons licenses are early examples of a layered approach including code. Their license layers are the Legal Code, the Commons Deed (“human readable” version), and the Code layer. “In order to make it easy for the Web to know when a work is available under a Creative Commons license, we provide a ‘machine readable’ version of the license – a summary of the key freedoms and obligations written into a format that software systems, search engines, and other kinds of technology can understand. … Taken together, these three layers of licenses ensure that the spectrum of rights isn’t just a legal concept. It’s something that the creators of works can understand, their users can understand, and even the Web itself can understand.” [See “Three ‘Layers’ of Licenses” at Creative Commons n.d.].

GPT-3 and other language models are already capable to move from text to code, creating functional code from ordinary language prompts. OpenAI Codex, for example, is an AI system that translates natural language to code [OpenAI 2021(b)]. Corrales Compagnucci, Fenwick and Haapio [2022] focus on the need of contracts to be both legally functional and comprehensible for their users (whether people or machines), envisioning the computable contract designer of the future employing no- or low-code software solutions to design and build customized digital contracts. We, in turn, envision that in the near future we can write a prompt, a short description of what we want, for example a four-layered layout, and submit it to GPT-3 (or ChatGPT, GPT-4 or higher), which then generates the code which generates what we want.

5.

Conclusions ^

The EU has launched a wealth of proposed new legislation that forces those who are impacted to take sustainability into account in various aspects of business. The proposed legislation also aims at preventing sustainability from being used just as a marketing trick. However, the overflowing tsunami of sustainability information threatens the actionability of the information. Readers may not find the information they need, understand what they find or know how to act upon it, and writers may end up in trouble with stricter obligations to produce all the required reports and other information – not to mention the challenges encountered when attempting to ensure that their organization and value chain comply with the requirements.

As we have argued in an earlier IRIS context, plain language and information design can help overcome communication challenges and make complex messages clear and human-actionable [Salo/Haapio 2017]. In this paper, we argue that GPT-3 and other AI tools can help both readers and writers of sustainability communications, varying from ESG reports and disclosures to contracts and guidance. AI tools can act as “reading tools” for investors and other users, and as “writing tools” or “drawing tools” for creators of information. Better still, humans and machines can effectively work together to create actionable sustainability information and with it, address the causes of ESG problems and monitor and strengthen sustainability.

6.

References ^

Blei, David M./Ng, Andrew Y./Jordan, Michael I., Latent Dirichlet Allocation. The Journal of Machine Learning Research, Vol. 3, No. 2, 2003, p. 993–1022.

Brown, Tom B. et al., Language Models Are Few-Shot Learners. arXiv:2005.14165v4 [cs.CL] 22 July 2020, https://arxiv.org/pdf/2005.14165.pdf (accessed on 25 October 2022).

Corrales Compagnucci, Marcelo/Fenwick, Mark/Haapio, Helena, Digital Technology, Future Lawyers and the Computable Contract Designer of Tomorrow. In: Corrales Compagnucci, Marcelo/Haapio, Helena/Fenwick, Mark (Eds), Research Handbook on Contract Design. Edward Elgar, Cheltenham 2022, p. 421–444.

Council of the European Union, Document ST 10835 2022 INIT, 10835/22, MVG/TB/PB/ed, COMPET 2. Bryssels, 30 June 2022, https://www.consilium.europa.eu/media/57644/st10835-xx22.pdf (accessed on 25 October 2022).

Creative Commons, About The Licenses, http://creativecommons.org/licenses (accessed on 25 October 2022).

Devlin, Jacob/Chang, Ming-Wei/Lee, Kenton/Toutanova, Kristina, BERT: Pre-training of Deep Bidirectional Transformers for Language Understanding. ArXiv:1810.04805 [Cs] 2019, http://arxiv.org/abs/1810.04805 (accessed on 25 October 2022).

Dyer, Travis/Lang, Mark/Stice-Lawrence, Lorien, The Evolution of 10-K Textual Disclosure: Evidence from Latent Dirichlet Allocation. Journal of Accounting and Economics, Vol. 64, No. 2–3, 2017, p. 221–245. https://doi.org/10.1016/j.jacceco.2017.07.002.

ESMA (European Securities and Markets Authority), European Single Electronic Format, https://www.esma.europa.eu/policy-activities/corporate-disclosure/european-single-electronic-format (accessed on 25 October 2022).

European Commission, The European Green Deal. COM(2019) 640 final, Brussels, 11.12.2019.

European Commission. Communication From the Commission to the European Parliament, the Council, the European Economic and Social Committee of the Regions on a Digital Finance Strategy for the EU. COM(2020) 591 final, Brussels, 24.9.2020.

European Commission, EU Taxonomy, Corporate Sustainability Reporting, Sustainability Preferences and Fiduciary Duties: Directing finance towards the European Green Deal. COM(2021) 188 final, Brussels, 21.4.2021.

European Commission, Proposal for a Directive of the European Parliament and of the Council amending Directive 2013/34/EU, Directive 2004/109/EC, Directive 2006/43/EC and Regulation (EU) No 537/2014, as regards corporate sustainability reporting. COM(2021) 189 final. Brussels, 21.4.2021.

European Commission, Strategy for Financing the Transition to a Sustainable Economy. COM(2021) 390 final, Strasbourg, 6.7.2021.

European Commission, Proposal for a Regulation of the European Parliament and of the Council on the making available on the Union market as well as export from the Union of certain commodities and products associated with deforestation and forest degradation and repealing Regulation (EU) No 995/2010. COM(2021) 706 final. Brussels, 17.11.2021.

European Commission, Impact Assessment Report. SWD(2021) 344 final, Brussels, 25.11.2021.

European Commission, Proposal for a Regulation of the European Parliament and of the Council establishing a European single access point providing centralised access to publicly available information of relevance to financial services, capital markets and sustainability. COM(2021) 723 final. Brussels, 25.11.2021.

European Commission, Proposal for a Directive of the European Parliament and of the Council on Corporate Sustainability Due Diligence and amending Directive (EU) 2019/1937. COM(2022) 71 final. Brussels, 23.2.2022.

European Commission, Proposal for a Regulation of the European Parliament and of the Council on Nature Restoration. COM(2022) 304 final. Brussels, 22.6.2022.

European Commission, Directorate-General for Financial Stability, Financial Services and Capital Markets Union/Uličná, Daniela/Vincze, Máté/Mosoreanu, Marius et al., Disclosure, Inducements, and Suitability Rules for Retail Investors Study: Final Report, Publications Office of the European Union, Luxembourg 2022, https://data.europa.eu/doi/10.2874/647061 (accessed on 25 October 2022).

Gehman, Samuel/Gururangan, Suchin/Sap, Maarten/Choi, Yejin/Smith, Noah A., RealToxicityPrompts: Evaluating Neural Toxic Degeneration in Language Models, arXiv 2020. https://doi.org/10.48550/arXiv.2009.11462 (accessed on 19 December 2022).

Haapio, Helena, Transforming Contract Creation : Goodbye to Legal Writing – Revisited. In: Schweighofer, Erich/Hötzendorfer, Walter/Kummer, Franz/Saarenpää, Ahti (Eds), Responsible Digitalization. Proceedings of the 23rd International Legal Informatics Symposium IRIS 2020, Editions Weblaw, Bern 2020, p. 459–466.

Haapio Helena/Passera Stefania, Contracts as Interfaces: Visual Representation Patterns in Contract Design. In: Katz, Daniel Martin/ Dolin, Ron/Bommarito, Michael J. (Eds), Legal Informatics. Cambridge University Press, Cambridge 2021, p. 213–238.

IACCM, The Purpose of a Contract: An IACCM research report. International Association for Contract and Commercial Management 2017. https://www.worldcc.com/Portals/IACCM/resources/files/9876_j18069-iaccm-purpose-of-contract-a4-2017-11-14-v1-webready.pdf (accessed on 25 October 2022).

ISO 32210:2022(en). Sustainable finance – Guidance on the application of sustainability principles for organizations in the financial sector, https://www.iso.org/obp/ui/#iso:std:iso:32210:ed-1:v1:en (accessed on 25 October 2022).

Kolk, Ans, A Decade of Sustainability Reporting: Developments and Significance. International Journal of Environment and Sustainable Development, Vol. 3, No. 1, 2004, p. 51–64.

LeCun, Yann/Bengio, Yoshua/Hinton, Geoffrey, Deep Learning. Nature, Vol. 521, 2015, p. 436–444. https://doi.org/10.1038/nature14539.

Loughran, Tim/McDonald, Bill, The Use of Edgar Filigs by Investors. Journal of Behavioral Finance, Vol. 18, No. 2, 2017, p. 231–248. https://doi.org/10.1080/15427560.2017.1308945.

Mikolov, Tomas/Chen, Kai/Corrado, Greg/Dean, Jeffrey, Efficient Estimation of Word Representations in Vector Space. ArXiv:1301.3781 [Cs] 2013, http://arxiv.org/abs/1301.3781 (accessed on 25 October 2022).

OpenAI, OpenAI API, https://openai.com/api/ (accessed on 25 October 2022).

OpenAI, DALL·E: Creating Images from Text, 2021, https://openai.com/blog/dall-e/ (accessed on 26 October 2022).

OpenAI, OpenAI Codex, 2021, https://openai.com/blog/openai-codex/ (accessed on 26 October 2022).

OpenAI, Aligning Language Models to Follow Instructions, 2022, https://openai.com/blog/instruction-following/ (accessed on 26 October 2022).

Ranta, Mikko/Ylinen, Mika/Järvenpää, Marko, Machine Learning in Management Accounting Research: Literature Review and Pathways for the Future. European Accounting Review 2022, p. 1–30. https://doi.org/10.1080/09638180.2022.2137221.

Salo, Marika/Haapio, Helena, Robo-Advisors and Investors: Enhancing Human-Robot Interaction Through Information Design. JusletterIT, 23 February 2017.

The Net Zero Asset Managers initiative, http://www.netzeroassetmanagers.org (accessed on 25 October 2022).

Waller, Robert/Passera, Stefania/Haapio, Helena, Layered Contracts: Both Legally Functional and Human-Friendly. In: Jacob, Kai/Schindler, Dierk/Strathausen, Roger/Waltl, Bernhard (Eds), Liquid Legal – Humanization and Law. Law for Professionals. Springer, Cham 2022, p. 269–287.

Waller, Robert, Designing Contracts for Human Readers. In: Corrales Compagnucci, Marcelo/Haapio, Helena/Fenwick, Mark (Eds), Research Handbook on Contract Design. Edward Elgar, Cheltenham 2022, p. 55–74.